The Final Information To Reward Level Stacking 2025

I like loyalty programmes and bank card rewards as a result of they’ve reworked my journey experiences. In the event you comply with MuslimTravelGirl, you’ll know I at all times encourage you to make a behavior of utilizing reward factors in your day by day life to maximise your financial savings and journey extra.

Right here is precisely how I exploit reward level stacking within the UK, a market that, sadly, will not be as beneficiant as that within the USA however nonetheless offers a implausible strategy to earn factors day by day. In any case, each little helps. (It actually does sound like a Tesco commercial)

I’m presently operating a free 5-day miles and factors class for Muslim travellers (extra info under) on the way to get began, and one of many questions is what are precisely reward portals and the way they work. As a result of as soon as you already know, your buying will change for the higher.

It isn’t laborious to earn rewards as soon as you know the way and the place to search for them.

This put up is for these completely new to this journey hacking recreation, so skip it when you already realize it.

Why Reward Stacking Issues

In the event you’ve ever doubted that loyalty rewards programmes within the UK may be game-changing for saving and travelling affordably, suppose once more. Whereas the UK market might not be as reward-rich because the USA, there are nonetheless loads of alternatives to earn Avios factors, save on on a regular basis purchases, and plan cost-effective journey.

As a single mom and now formally on a single earnings, I can earn sufficient factors by way of my day by day spending for no less than one journey per yr. Provided that I’m presently saving cash, this can be a nice achievement.

As Muslim travellers, probably the greatest methods to build up factors is thru our day by day spending. Though miles and reward programmes are halal, many Muslims are nonetheless lacking out.

I don’t advocate credit score churning as a Muslim traveller as a result of this may result in debt, however steadily rising your level accumulation through portals and stacking factors whereas utilizing playing cards responsibly is my secret weapon.

If you’re a household, you may shortly accumulate extra factors. This is applicable to readers within the US and UK. In the event you dwell abroad, test your individual programmes; even Saudi Arabia for instance, has them.

I’ve employed these methods to avoid wasting 1000’s on journeys, resort stays, and even day by day purchases. Under, you will note an instance for Nespresso; nonetheless, simply yesterday (as I write this), I accrued extra factors at Boots.

What Is Reward Level Stacking?

Reward level stacking refers back to the strategy of layering a number of rewards methods——equivalent to bank card factors, buying portal bonuses, and retailer reductions—on prime of each other to maximise yearnings. This strategy works within the US and UK, although the particular instruments and affords might differ by area.

For example, bank card bonuses and loyalty programmes are extra beneficiant within the US. In the meantime, within the UK, programmes could also be smaller in scale, however with cautious planning, you may nonetheless earn significant rewards at decrease prices.

Step-by-Step Breakdown: Tips on how to Stack Rewards within the UK

1. Earn Cashback with Credit score Card Presents

These days, many bank cards, debit playing cards, and even the Revolut card I exploit for travelling supply cashback choices

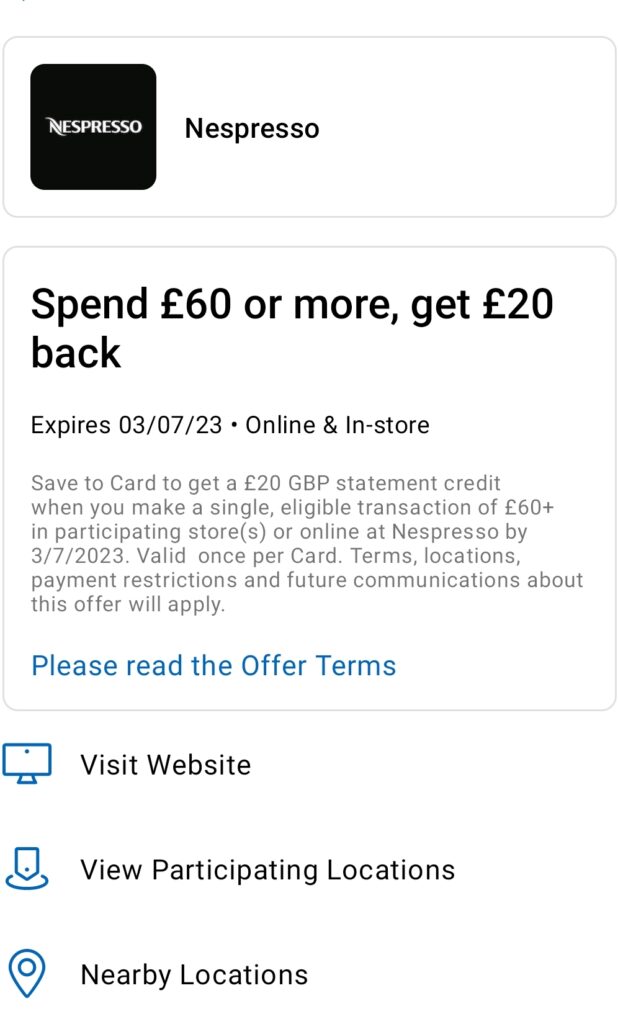

I at all times test which card offers me probably the most cashback return. I exploit this in eating places and even like the instance under for my espresso. My American Categorical Platinum had a suggestion of spending £60 and getting £20 again; this can be a good return for positive. It offers you 33% again in your buying.

Top-of-the-line instruments in your reward-stacking arsenal is a rewards bank card, notably American Categorical Platinum or Amex Gold. These playing cards often supply rewards that remodel on a regular basis purchases into financial savings and factors alternatives.

In the previous couple of years, my Amex affords have saved me over £1400, and this doesn’t rely the limitless lounge entry, insurance coverage claims, spending overseas, or the advantages of my platinum card.

💡 Professional Tip: Enthusiastic about beginning with American Categorical? Try the Amex Gold card, which is free for the primary yr and affords rewarding sign-up bonuses.

2. Leverage Retailer Promotions

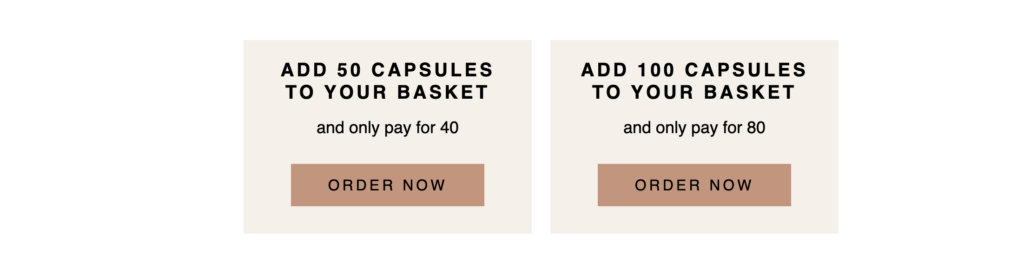

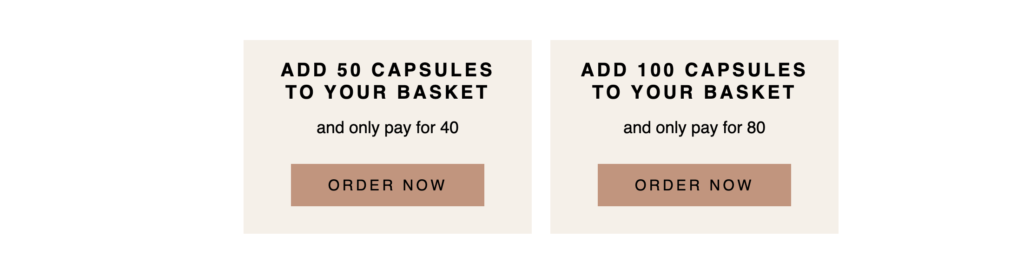

Each few months, Nespresso sends me an e-mail with affords for pods and reductions.

Sometimes, it includes shopping for a sure amount to obtain an equal quantity totally free. Additionally it is important to subscribe to emails and rewards from retailers you want.

On this supply, they’d to purchase 100 pods and get 20 free. Since I used to be operating low on espresso pods and will fill up for a couple of months, I made a decision it was time to mix the affords.

Many retailers often supply reductions or rewards for loyal clients. Subscribing to retailer emails ensures that you just gained’t miss such affords alternatives.

You’ll be able to go direct and purchase the supply, however you can be lacking an important piece of the puzzle.

3. Use Buying Portals for Bonus Factors

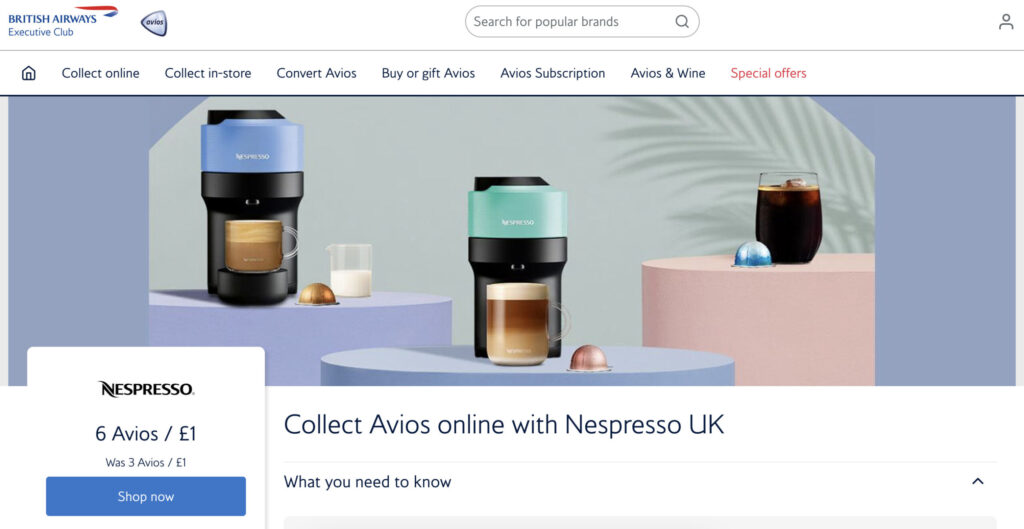

When you have learn this text, you already know I just about at all times store through a buying portal, whether or not it’s Topcashback, Virgin Atlantic or my beloved BA buying portal.

I don’t make a web based buy with out checking these web sites to see who affords the most effective rewards.

This all comes all the way down to technique and your plan for these rewards. For instance, if I’m trying to prime up my Avios account, I’ll use the Avios portal to stack the rewards.

Often, Topcashback will probably be for very massive purchases for instance, on insurance coverage, the place I can get extra cash again. If you’re not signed as much as Topcashback then be sure you do right here.

Buying portals such because the BA (British Airways) portal, Topcashback, or Virgin Atlantic present bonus factors or cashback for purchases made by way of their service platforms.

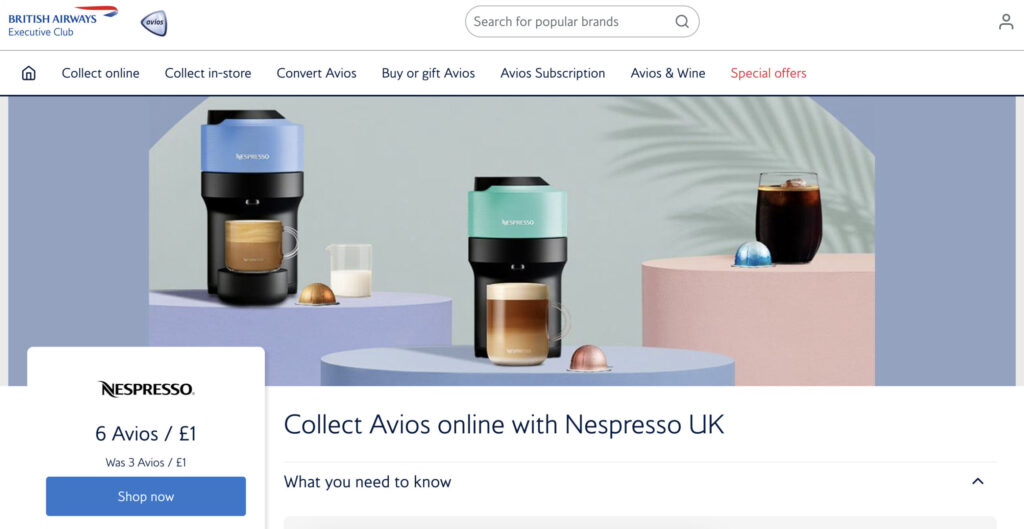

For this instance, I used the BA Buying Portal, which gave me 6 Avios per £1 spent—100% greater than the traditional fee of three Avios.

💡 Essential: Suppose strategically about your goal rewards objective. For example, when you’re saving miles for a visit, concentrate on portals that supply factors towards that particular loyalty programme.

This manner, you may mix all of the rewards when making a purchase order.

4. Promo Codes and Plugins

I’ve downloaded plug-ins like Rakuten, Honey and Coupert to mechanically scan the web for additional rewards and coupons. This has saved me a couple of hundred {dollars}/kilos over the previous yr. Typically, they do discover coupons, and others don’t. It’s okay. It’s simply an additional saving, which is at all times welcome.

On a latest journey to the airport, I saved £16 utilizing that technique.

Don’t miss out on an additional low cost! Utilise browser extensions

Instruments to Attempt:

On this possibility, I didn’t discover any additional coupons to make use of.

How You Mix the Rewards

Now that you just perceive the person elements let’s mix the steps into one seamless course of:

- Go to the Buying Portal (e.g., BA Portal): Clear your cookies and log in.

- Activate the Retailer Provide: Make sure the promotional objects are in your cart.

- Use American Categorical Provide (if in case you have one or one other card): Pay together with your card that has an lively supply.

- Leverage Browser Plugins: Scan for any further promo codes or perks.

In my Nespresso instance, I went to the portal first, I then signed up for my Nespresso account, which exhibits my affords of £ 100 with 20 complimentary pods.

I needed to attain the minimal spend required by American Categorical to set off the supply of spending £ 60 and getting £20.

In the long run, I obtained roughly 6×62 = 360 Avios. Not a big quantity, however once more, each little helps.

This additionally triggered my Amex supply, so I paid £42 out of pocket and obtained 42 Amex factors as further rewards on my card.

Ultimate End result: You’ve earned 360 Avios, saved £20 due to Amex, and paid simply £42 for £60 value of products.

In complete, I purchased 172 pods of Nespresso espresso for £42.

That is an instance of how one can stack and accumulate loyalty rewards as a part of your on a regular basis life with out making it a burden on your self or stressing about it.

My USA Readers: Reward Level Stacking American Type

In the event you’re following MuslimTravelGirl from the USA, you’re in luck! The reward-stacking panorama in America is much more beneficiant than within the UK, offering larger bonuses and better alternatives to build up factors shortly.

Right here’s the way to optimise reward stacking within the USA:

1. Premium Credit score Playing cards with Main Bonuses

Within the USA, the bank card panorama is considerably extra rewarding with larger bonuses:

- Capital One / American Categorical: These playing cards supply large sign-up bonuses (typically 60,000+ factors) and 3x-5x factors on journey and eating purchases. The Chase Final Rewards portal permits you to switch factors to a number of airways and motels or e book journey instantly at enhanced charges.

- American Categorical Platinum or Gold: These playing cards present wonderful Membership Rewards factors that switch to Delta, British Airways, and plenty of different companions. Amex affords are additionally usually extra beneficiant within the US market.

💡 Professional Tip: In contrast to the UK market, the US affords many extra alternatives for bank card “churning” – signing up for brand new playing cards to earn bonuses. Simply be sure you monitor software dates and handle your credit score responsibly.

Many bank cards presently have excessive sign-up bonuses, so test them out.

2. Highly effective Buying Portals

US buying portals usually supply larger charges than their UK counterparts:

- Airline-specific portals, equivalent to Delta SkyMiles Buying or American Airways AAdvantage eShopping, let you earn as much as 10x factors per greenback spent at standard shops.

- Capital One portal affords cashback and a plug-in that you should use for journey in addition to day by day buying. It not solely affords bonus factors however typically options enhanced charges throughout promotions. They’ve many retailers, together with Airbnb, which is often booked by many Muslim households and isn’t obtainable on cashback websites

- Rakuten (previously Ebates) affords the distinctive choice to earn both money again or American Categorical Membership Rewards factors, providing you with flexibility primarily based on journey targets. I want we had that Amex possibility within the UK.

Stacking Instance: US Type

Let’s take a look at how this may work with a purchase order at Apple:

- Store by way of the American Airways portal, incomes 3x miles per greenback

- Pay together with your reward-earning bank card for a further x factors

- Examine for extra bank card affords primarily based in your playing cards like AmEx affords if in case you have an American Categorical card

End result: On a $1,000 laptop computer buy, you can earn 3,000 American Airways miles plus 1,000 Chase Final Rewards factors, doubtlessly value $80-$100 in journey worth, plus any promotional objects.

This similar strategy works for on a regular basis purchases like groceries, eating, and occasional pods!

💡 Essential Word for Muslim Vacationers: The abundance of bank card choices within the US means extra alternatives, but in addition requires extra self-discipline. All the time pay your balances in full to keep away from curiosity (riba) and maintain the rewards halal.

Gradual and Regular Wins the Race

Signal-up bonuses are implausible, notably when you favor to not swap between quite a few bank cards. Moreover, as a Muslim, I favour a gentle and gradual accumulation of rewards, as, by the top of the yr, they contribute considerably, making it possible to journey for much less.

It’s a life-style change, not a race!

Reward stacking doesn’t need to be overwhelming or time-consuming. You’ll be able to flip on a regular basis purchases into significant financial savings and journey rewards by combining bank card affords, retailer loyalty programmes, buying portals, and promo instruments.

So subsequent time you suppose that reward programmes don’t work, think about the way to maximise them on your personal profit and journey for much less.

Whether or not you’re shopping for espresso pods, groceries, or greater purchases, begin stacking rewards at present as a result of each little helps (sure, just like the Tesco advert)!

Name to Motion: Be sure to signal as much as my miles and factors free course providing you with ideas you may really implement.

FAQs: Reward Stacking Fundamentals

Do rewards programmes like Avios or Amex affords repay?

Completely! By stacking affords strategically, it can save you tons of yearly on journey and purchases. In the event that they didn’t there wouldn’t be such an enormous trade.

What’s the most effective bank card for novices?

Relying in your methods. Amex Gold is normally a superb begin, particularly for these within the UK. Free for the primary yr and advantages value tons of.

What ought to I concentrate on as a Muslim traveller?

Gradual and regular rewards accumulation works finest. Keep away from stress over bank card churning and concentrate on life-style change, together with utilizing the ideas above. It is a sustainable long-term halal technique.

Are US or UK reward applications higher?

US applications usually supply larger rewards and extra choices, however UK applications nonetheless present wonderful worth when strategically utilised. The ideas of stacking work in each nations – it’s only a matter of scale.

Wish to study extra? Try the articles under

Loyalty Programmes and the way they work

The Avios Behavior – How I’ve saved 1000’s redeeming Avios factors

Step by Step Information: Tips on how to Switch Amex Factors to Airways