Options to Month-to-month Spousal Upkeep in Washington: Versatile Assist Choices

When most individuals take into consideration spousal upkeep, they image month-to-month checks stretching for years. However right here’s what many divorcing {couples} don’t notice: month-to-month funds aren’t your solely possibility, and sometimes they’re not even the best choice. Washington provides you large flexibility to construction upkeep in ways in which may higher fit your distinctive monetary state of affairs.

As a mediator with an MBA in Finance, I’ve helped {couples} construction upkeep in dozens of ways in which would by no means emerge from inflexible litigation. Some paid every thing upfront in lump sums. Others traded upkeep for retirement property—some structured funds round instructional targets. Understanding the monetary implications and working the precise numbers made all of the distinction in reaching agreements each events felt good about.

Why Contemplate Options to Conventional Month-to-month Upkeep?

Conventional month-to-month upkeep has vital drawbacks. For paying spouses, it creates ongoing monetary and emotional ties that by no means appear to finish. For receiving spouses, it creates dependency and uncertainty about whether or not funds will arrive reliably.

Each events usually really feel caught in a relationship that’s speculated to be over. Different buildings can eradicate these points, giving each events a cleaner break and extra certainty. From a monetary planning perspective, options can even create alternatives for tax benefits, funding alternatives, and higher asset leverage that conventional buildings don’t supply.

Lump-Sum Upkeep: The Monetary Evaluation

As an alternative of paying $2,000 monthly for ten years, the paying partner transfers a single sum at divorce. A easy idea, but it surely requires subtle monetary evaluation to be structured pretty.

Paying $2,000 monthly for ten years totals $240,000. However ought to the lump sum match that determine? No, as a result of the time worth of cash issues enormously. A greenback at present is value greater than a greenback in ten years. If the receiving partner will get $240,000 at present and invests it conservatively at 5% yearly, it grows to just about $391,000—dramatically greater than receiving $240,000 in month-to-month funds over time.

Utilizing a 5% low cost charge, the current worth of $2,000 monthly for ten years is roughly $188,000—about 22% lower than the nominal whole of month-to-month funds. This isn’t about shortchanging anybody; it’s about recognizing financial equivalence.

Different components matter too. The danger of non-payment if the payer loses their job strongly favors lump-sum preparations for recipients. Transaction prices—120 funds versus one—favor simplicity for each events. Funding alternative issues considerably if the recipient is financially savvy and may develop that capital. Liquidity is essential—can the payer truly entry $188,000 now with out decimating their retirement or taking up debt?

Tax implications are important and sophisticated. For divorces finalized after December 31, 2018, month-to-month upkeep isn’t tax-deductible for payers or taxable for recipients. However structuring funds as property division reasonably than upkeep may lead to totally different tax therapy. That is the place you completely want steerage from a CPA or tax lawyer to construction issues appropriately.

With my finance background, I assist {couples} work by current worth calculations, mannequin totally different funding eventualities, and decide the lump-sum quantity that really represents honest financial worth. This type of subtle evaluation—which might price hundreds in case you employed dueling monetary consultants in litigation—occurs cooperatively in mediation at a fraction of the fee.

Buying and selling Upkeep for Property: Artistic Asset Division

One other highly effective various is buying and selling upkeep for a bigger property settlement. As an alternative of paying ongoing upkeep, the upper earner transfers extra property to the decrease earner.

In Washington, neighborhood property are usually divided pretty equally, and upkeep is set individually. In mediation, you’ll be able to creatively hyperlink these two elements.

Right here’s a typical state of affairs: $600,000 in neighborhood property (usually $300,000 every) plus $1,500 month-to-month upkeep for seven years ($126,000 whole). As an alternative, the decrease earner receives $400,000 in property with no upkeep. The upper earner retains $200,000 with no ongoing obligation.

Why this works for each events: The recipient will get $100,000 additional in property as a substitute of $126,000 in upkeep over time, seemingly giving up $26,000 on paper however gaining instant management of capital, eliminating dependency on month-to-month funds, and avoiding danger of non-payment. The payer pays $100,000 additional now however saves $126,000 over time, nets $26,000 forward, and eliminates 84 month-to-month funds and the continued emotional connection. The clear break usually feels value way over the nominal financial savings.

This works significantly properly with house fairness. The decrease earner retains the home with substantial fairness, whereas the upper earner retains retirement accounts. No upkeep adjustments fingers as a result of property division already accounts for assist wants.

The secret’s understanding true monetary equivalence by present-value evaluation, investment-return projections, liquidity wants for each events, and danger tolerance. You could doc this association clearly as property division, not upkeep, for correct tax therapy.

Each couple’s state of affairs is exclusive, and that’s why we don’t imagine in one-size-fits-all processes. As an alternative, we develop personalised options that deal with your particular wants, asset composition, and monetary circumstances. In case your funds contain complicated property like enterprise pursuits, inventory compensation, or vital actual property holdings, having a mediator with deep monetary experience helps you construction these trades in ways in which defend what you’ve constructed whereas guaranteeing each spouses are well-positioned for his or her respective futures.

Rehabilitative Upkeep: Investing in Future Self-Sufficiency

Rehabilitative upkeep shifts focus from ongoing assist to time-limited funding in incomes capability. As an alternative of indefinite funds, the payer funds particular schooling or coaching that allows future self-sufficiency.

This works when there’s a transparent path ahead. Maybe the recipient wants a grasp’s diploma, up to date abilities after workforce absence, or coaching to transition to higher-paying work.

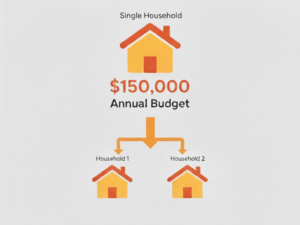

Instance: As an alternative of $2,500 month-to-month for 5 years ($150,000 whole), pay for a two-year MBA program costing $80,000 plus $30,000 yearly for dwelling bills throughout college. Complete: $140,000 over two years. The recipient then has a dramatically larger incomes potential and should not want assist.

Monetary evaluation requires projecting future earnings capability and completion timelines, that are inherently unsure, but it surely gives a framework for analysis.

For paying spouses, rehabilitative upkeep usually feels extra palatable—you’re investing in future independence with a transparent endpoint reasonably than writing checks indefinitely. For receiving spouses, it represents empowerment and funding in your self, although it includes some danger if schooling doesn’t result in anticipated revenue will increase.

How Washington approaches this explicitly acknowledges upkeep centered on rehabilitation and coaching. Contemplate together with provisions that deal with dangers, resembling continued funds for an outlined interval after schooling completion if employment hasn’t been secured at anticipated ranges.

We don’t simply allow you to construction the preliminary association. We allow you to anticipate what may occur if plans change—what if this system takes longer than anticipated, what if the job market is tougher, what if well being points intervene. By planning for these velocity bumps now and constructing applicable flexibility into your settlement, you’ll be able to transfer ahead confidently with out consistently worrying about future disputes.

Declining Cost Buildings: Gradual Transition to Independence

As an alternative of flat month-to-month upkeep, you’ll be able to construction funds that decline over time as incomes capability will increase—recognizing the fact of transitioning to self-sufficiency.

Instance: Slightly than $2,000 month-to-month for eight years (whole: $192,000), construction it as $3,000 month-to-month for 2 years, $2,500 for years three and 4, $2,000 for years 5 and 6, and $1,500 for years seven and eight. The overall paid stays equal at $192,000, however the timing displays precise wants.

This acknowledges post-divorce actuality. The primary couple of years are sometimes hardest financially as you determine separate households and alter to new circumstances. Increased funds present essential assist when most wanted. Because the recipient turns into extra established in work and life, they want progressively much less assist.

The recipient can finances with certainty whereas having a built-in incentive to extend earnings. The payer sees a transparent path towards diminished obligations reasonably than feeling trapped in perpetual funds.

You’ll be able to construction declines round particular milestones: maybe $2,500 monthly till diploma completion, then $1,500 for 3 years after. Or tie reductions to revenue will increase: when the recipient’s revenue reaches $60,000, funds drop to $1,500. These milestone-based buildings require cautious drafting to keep away from future disputes, however they create highly effective incentives aligned with the aim of independence.

Entrance-Loading Upkeep: Increased Funds for Shorter Period

Some {couples} negotiate greater upkeep for a shorter length. As an alternative of $1,500 month-to-month for ten years, maybe $3,000 month-to-month for 5 years. Precise whole ($180,000), fully totally different dynamics.

For receiving spouses: extra strong instant assist throughout the hardest adjustment interval, plus attaining independence sooner. For paying spouses: greater short-term price however earlier freedom from ongoing obligations.

Monetary planning requires sincere evaluation. Can the recipient realistically change into self-sufficient in 5 years with the upper assist? Will the paying partner’s revenue comfortably assist the upper funds with out creating monetary hardship?

Contemplate constructing in flexibility: $3,000 monthly for 5 years, but when the recipient secures employment above a sure threshold, funds scale back or terminate early. This protects each events whereas creating applicable incentives.

The Tax Wildcard: Understanding Present Implications

Tax implications modified dramatically for divorces finalized after December 31, 2018. Beforehand, upkeep was tax-deductible for payers and taxable for recipients, creating tax arbitrage alternatives when payers had been in greater tax brackets than recipients.

Below present regulation, upkeep is neither deductible nor taxable. Each events are utilizing after-tax {dollars}, which suggests payers want extra gross revenue to supply the identical internet profit to recipients. This actuality usually means decrease upkeep quantities are negotiated, or {couples} discover various buildings that provide worth in different methods.

Nonetheless, property transfers incident to divorce are typically not taxable occasions beneath IRC Part 1041. Structuring preparations as property division reasonably than upkeep follows fully totally different tax guidelines. For instance, buying and selling upkeep for added retirement property means the recipient doesn’t pay tax when receiving them (although they’ll pay abnormal revenue tax later when withdrawing funds in retirement, doubtlessly at decrease charges).

That is genuinely complicated territory requiring steerage from a CPA or tax lawyer. The precise construction and wording considerably have an effect on tax therapy, and small adjustments can have vital implications. Skilled tax steerage pays for itself many instances over if you’re structuring these preparations. I work carefully with tax professionals when {couples} are exploring these options to make sure preparations are appropriately structured for optimum tax therapy.

Making the Alternative: What’s Proper for Your Scenario?

With these options out there, how do you resolve? I actively information you thru actually assessing a number of components.

Contemplate liquidity and money circulation.

Does the paying partner have entry to a lump sum with out decimating retirement or taking up debt? Can they afford greater short-term funds? Does the receiving partner have the monetary self-discipline to handle a big lump sum responsibly?

Consider danger tolerance.

Are you snug with funding return uncertainty? How necessary is safety versus potential upside? Some recipients favor assured month-to-month funds, even at a decrease current worth, just because certainty has actual psychological worth value paying for.

Take into consideration your relationship going ahead.

If in case you have kids, you’ll be co-parenting for years. Does ongoing upkeep complicate that relationship? When you strongly favor a clear break with minimal ongoing contact, buildings that eradicate ongoing funds change into way more enticing.

Assess sensible incomes potential.

If the recipient has clear capability to change into self-sufficient inside a number of years, rehabilitative or declining buildings make glorious sense. If incomes potential is genuinely restricted by age, well being, or different components, longer-term assist is perhaps crucial no matter construction.

Lastly, contemplate emotional components.

Generally the “greatest” monetary deal on paper isn’t one of the best total deal if it creates ongoing anxiousness or resentment. The settlement that lets each of you progress ahead with real peace of thoughts, even when not theoretically optimum financially, is perhaps the completely proper selection in your state of affairs.

The Mediation Benefit for Artistic Upkeep Buildings

Right here’s what makes mediation so highly effective for these various upkeep buildings: in litigation, you’re basically caught arguing for month-to-month funds or no funds. Attorneys combat over quantities and length whereas working inside inflexible templates that judges are snug ordering. Artistic options like lump sums, property trades, or declining buildings hardly ever emerge as a result of they require subtle monetary evaluation, collaborative problem-solving, and suppleness that the adversarial courtroom course of doesn’t accommodate.

In mediation, we will discover all of those choices and extra. We don’t require you to suit into predetermined classes or argue for excessive positions. I carry choices to the desk you may by no means have thought of, allow you to perceive the monetary implications of every construction, and information you thru negotiations that lead to inventive agreements far superior to something litigation would produce.

With my MBA in finance and almost 20 years of expertise, I’ve analyzed tons of of those various buildings. I can run current worth calculations, mannequin funding eventualities, consider tax implications, and allow you to perceive the precise financial worth of various approaches. This type of subtle monetary evaluation—which might price tens of hundreds if every celebration employed their very own monetary professional in litigation—occurs cooperatively in mediation at a fraction of the fee.

We will mannequin precisely what totally different buildings imply for every partner’s monetary image—not simply instantly, however 5 years out, ten years out, and into retirement. We will stress-test assumptions about funding returns, revenue development, and life adjustments. This complete evaluation helps you make knowledgeable selections primarily based on actual knowledge reasonably than concern, anger, or incomplete understanding.

And critically, this course of preserves your relationship reasonably than destroying it by adversarial litigation. The cooperative problem-solving strategy means you’re working collectively to seek out options that serve each events’ pursuits reasonably than combating over inflexible positions. If in case you have kids, this cooperative basis makes co-parenting dramatically simpler. Even with out kids, ending your marriage by collaborative negotiation reasonably than bitter courtroom battles permits each of you to maneuver ahead with much less emotional injury and extra real hope in your respective futures.

Transferring Ahead with Artistic Options and Skilled Steering

The great thing about mediating your divorce in Washington is that you just’re not restricted to cookie-cutter month-to-month fee preparations. You’ll be able to construction upkeep in ways in which mirror your distinctive circumstances, priorities, and targets, in ways in which would by no means emerge from the inflexible litigation course of.

The {couples} who attain one of the best various upkeep buildings are those that work with an skilled mediator who really understands monetary complexity—somebody who can conduct subtle current worth evaluation, mannequin totally different eventualities, consider tax implications, and information you thru selecting buildings that maximize worth for each events.

I’m not an lawyer and may’t present authorized recommendation about your particular state of affairs. However I can information you thru a complete monetary evaluation of various upkeep buildings, allow you to perceive the trade-offs concerned, and facilitate negotiations that result in inventive agreements each events really feel genuinely good about. With my coaching from Harvard, MIT, and Northwestern, mixed with my MBA in finance, I carry each negotiation experience and monetary analytical abilities that can assist you discover options you may by no means have recognized existed.

The upkeep construction you select now will have an effect on your monetary life for years to return. Taking time to discover options past conventional month-to-month funds—with professional steerage by the monetary evaluation and negotiation course of—may lead you to options working much better in your state of affairs than the usual association everybody assumes is the one possibility.

That exploration, guided by somebody with deep monetary experience and in depth expertise creating these various buildings, is totally definitely worth the funding. It’s about defending what you’ve constructed, guaranteeing each spouses are well-positioned for his or her respective futures, and selecting options that allow you to transfer ahead with confidence, dignity, and real monetary safety reasonably than ongoing anxiousness and resentment.

That’s the facility of mediation with the precise monetary experience—creating higher outcomes by collaboration whereas supplying you with management over selections that can form your monetary future for years to return.