Divorce Settlement With a Particular Wants Little one: Defending Advantages & Constructing Safe Plans

Why IRAs are less complicated to divide – however nonetheless simple to mess up

Right here’s the excellent news about dividing IRAs in divorce: you don’t want a QDRO, that sophisticated court docket order required for 401(ok)s and pensions. The division course of is extra easy, the timeline is quicker, and there are fewer alternatives for plan directors to reject your paperwork.

However right here’s what I inform each couple in my mediation apply: less complicated doesn’t imply easy. I’ve seen individuals botch IRA transfers and set off huge tax payments they by no means noticed coming. I’ve seen {couples} cut up conventional IRAs whereas overlooking that one partner has a Roth IRA value 3 times as a lot post-tax. The mechanics is perhaps extra easy, however you’ll be able to nonetheless make costly errors in case you don’t know what you’re doing.

The bottom line is understanding that conventional IRAs and Roth IRAs are basically totally different animals, despite the fact that they’re each known as IRAs. The tax therapy differs completely, which implies a greenback in a conventional IRA isn’t value the identical as a greenback in a Roth IRA. This issues enormously while you’re attempting to divide retirement belongings pretty.

The switch incident to divorce: the way it really works

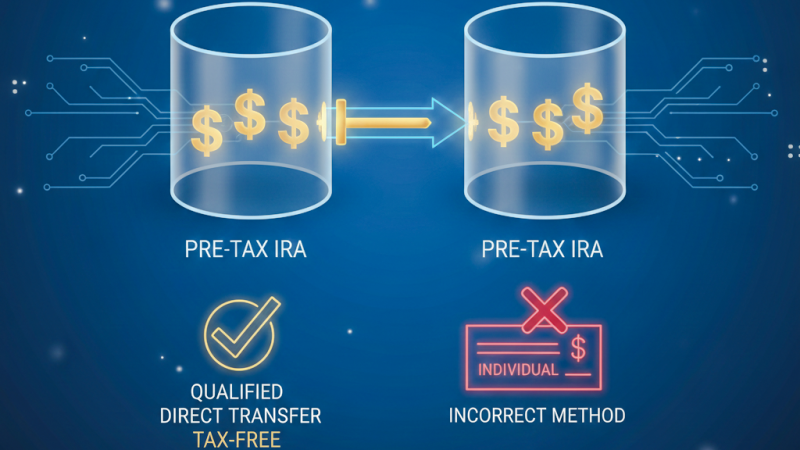

Whenever you’re dividing an IRA, you’re doing what’s known as a “switch incident to divorce.” The IRS permits this switch to occur tax-free while you comply with the method accurately. Break the principles, even unintentionally, and you could possibly owe earnings taxes plus penalties on the complete quantity.

Your divorce decree or settlement settlement specifies {that a} particular greenback quantity or proportion of 1 partner’s IRA can be transferred to the opposite partner’s IRA. As soon as the divorce is last – and this timing issues – the partner transferring cash contacts their IRA custodian with a replica of the divorce decree and directions to switch the desired quantity on to the opposite partner’s IRA.

The switch has to go straight from one IRA to a different. If the cash involves you as a verify made out to you personally, the IRS may deal with that as a distribution, which means you’d owe taxes and probably a ten% early withdrawal penalty in case you’re below 59½. Most main IRA custodians deal with these transfers routinely. The method isn’t sophisticated while you comply with their procedures, however you’ll want to comply with them precisely.

Conventional IRAs versus Roth IRAs: understanding the huge distinction

That is the place {couples} get into hassle. They see that one partner has a $100,000 conventional IRA and the opposite has a $100,000 Roth IRA, they usually determine they’re even. They’re not even shut.

A conventional IRA incorporates pre-tax cash. Each greenback you ultimately withdraw will get taxed as unusual earnings in retirement. Should you’re in a 25% tax bracket in retirement, your $100,000 conventional IRA is absolutely value $75,000 after taxes – and probably much less in case you’re in a better bracket.

A Roth IRA incorporates post-tax cash. You’ve already paid taxes on the cash earlier than it went in, so certified withdrawals in retirement come out utterly tax-free. That $100,000 Roth IRA is definitely value $100,000 in retirement spending energy.

When mediating circumstances involving each conventional and Roth IRAs, we guarantee {couples} perceive this distinction. Should you’re dividing retirement accounts equally, you’ll be able to’t simply cut up every account 50/50 with out contemplating the tax variations. You’ll want to both alter the division percentages or offset with different belongings to account for the truth that conventional IRA {dollars} are value lower than Roth IRA {dollars}.

Right here’s an actual instance from my apply

A California couple we mediated with had $400,000 in conventional IRAs mixed and $200,000 in Roth IRAs, for a complete of $600,000. They initially deliberate to every take half of every little thing – $200,000 in conventional IRAs and $100,000 in Roth IRAs. That cut up would have been equal after taxes, with every partner getting $250,000 in after-tax worth.

Nonetheless, the husband wished extra of the tax-free Roth cash and was prepared to take much less of the normal IRA to realize this. We labored via the mathematics assuming a 25% efficient tax fee in retirement. We adjusted the cut up to provide him $120,000 of the Roth and $173,000 of the normal, whereas the spouse bought $80,000 of the Roth and $227,000 of the normal. Regardless that the greenback quantities seemed unequal, they every nonetheless ended up with precisely $250,000 in after-tax worth – displaying how mediation helps you to customise the cut up to match your preferences whereas staying truthful.

These sorts of personalized options solely occur in mediation. In litigation, you’re caught with inflexible formulation and a stranger making choices about your monetary future. In mediation, you keep management and may construction preparations that truly work in your state of affairs.

Timing issues greater than you may suppose.

You can’t execute an IRA switch till your divorce is last. The divorce decree must be signed and entered. Should you attempt to switch IRA cash earlier than that occurs, the IRS gained’t deal with it as a switch incident to divorce. As an alternative, it is perhaps thought-about a taxable distribution adopted by a present. That’s a tax catastrophe.

Wait till you may have a last divorce decree. I do know it’s irritating to attend, particularly in case you’re apprehensive your partner may drain accounts. However triggering an pointless tax invoice since you moved too quick is worse.

As soon as the divorce is last, execute the switch comparatively promptly. Don’t let years go by. The longer you wait, the extra doubtless it’s that one thing goes mistaken – account values change, individuals neglect the agreed quantities, somebody remarries, and issues get sophisticated.

SEP-IRAs, SIMPLE IRAs, and rollover concerns

If both partner is self-employed or works for a small enterprise, they may have a SEP-IRA or SIMPLE IRA. These might be divided utilizing the switch incident to the divorce course of, similar to common IRAs. The larger subject is timing restrictions on SIMPLE IRAs – cash in a SIMPLE IRA usually can’t be rolled over to a conventional IRA till it’s been within the SIMPLE for a minimum of two years.

Typically one or each spouses have a 401(ok) from a earlier employer that they plan to roll into an IRA. Must you try this earlier than or after the divorce? Should you roll a 401(ok) into an IRA earlier than the divorce is last, the IRA is split utilizing the extra easy switch course of slightly than a QDRO. However you lose the choice for the receiving partner to reap the benefits of the QDRO exception to the ten% early withdrawal penalty.

If the non-employee partner desires to take cash out now and is below 59½, maintaining it within the 401(ok) and utilizing a QDRO is perhaps higher. If each spouses plan to depart the cash invested for retirement, rolling to an IRA first might simplify the division. These are judgment calls that rely in your particular state of affairs.

Why IRA division works nicely in mediation

Dividing IRAs doesn’t require the advanced court docket orders and prolonged approval processes that 401(ok)s and pensions do. That’s excellent news. However the simplicity of the method can lull individuals into pondering they don’t want knowledgeable steering, and that’s the place errors occur.

The distinction between a conventional IRA and a Roth IRA from a tax perspective is critical sufficient that getting this mistaken can value you tens of hundreds of {dollars}. Incorrectly timing the switch can set off tax penalties you by no means anticipated. Overlooking beneficiary designations or failing to coordinate with different retirement account divisions can create issues that don’t floor for years.

In mediation, we take the time to do that proper. We determine all of the accounts, perceive their traits, suppose via the tax implications, and construction a division that’s really equitable even when the account varieties differ. We execute the transfers accurately and on schedule, with clear documentation that protects each spouses.

Working with monetary experience makes a distinction

Right here’s what I’ve realized via 17 years of mediating divorces: IRAs is perhaps simpler to divide than different retirement accounts, however the tax implications and valuation variations between account varieties create complexity that calls for monetary experience.

My background in finance permits us to navigate this complexity collectively. We are able to mannequin totally different eventualities: What in case you take extra of the normal IRA and your partner takes extra of the Roth? What if we offset the IRA towards house fairness or different belongings? How do state earnings taxes issue into the equation if one in every of you is transferring to a unique state? In case your earnings consists of inventory choices, RSUs, or different fairness compensation flowing into retirement accounts, we are able to minimize via that complexity to search out clear solutions.

The pliability of mediation actually shines while you’re balancing retirement belongings with totally different tax therapies. In litigation, you’re usually caught with a inflexible 50/50 cut up of every account, whether or not that is sensible in your state of affairs or not. In mediation, we are able to construction preparations which might be equal in worth even when the greenback quantities differ, or that grant one partner extra management over sure belongings in trade for one thing else that issues extra to them.

We don’t simply deal with the rapid mechanics of your divorce. We allow you to suppose forward about your monetary future, anticipate how adjustments in circumstances may have an effect on your retirement planning, and construct agreements that provide you with confidence as you progress ahead. You’re not figuring this out alone or hoping you didn’t miss one thing necessary – you may have lively steering via each choice that impacts your monetary safety.

Your IRAs is perhaps the best retirement belongings to divide, however that doesn’t imply they’re not value taking significantly. The selection between mediation and litigation right here is obvious: mediation provides you management, flexibility, and the advantage of working with somebody who understands the monetary intricacies. Litigation arms your choices to somebody who doesn’t know your state of affairs and applies inflexible guidelines which may not serve both of you nicely.

Make knowledgeable choices, comply with the switch course of exactly, and set your self up for the retirement safety you’ve spent years constructing.