Divorce Settlement With a Particular Wants Little one: Defending Advantages & Constructing Safe Plans

Why pensions are essentially the most sophisticated asset in divorce

After practically twenty years of mediating divorces, I can let you know with certainty: pensions are the retirement asset that causes essentially the most confusion, essentially the most disagreement, and the costliest errors. That’s as a result of, in contrast to a 401(ok), the place you may see in the present day’s steadiness on a press release, a pension is a promise of future funds which may not begin for years and even many years. You’re attempting to divide one thing you may’t see, contact, or absolutely perceive till it begins paying out.

The valuation strategies are advanced, the alternatives about methods to divide pensions have enormous long-term implications, and if you happen to don’t deal with them appropriately up entrance, you’ll be coping with the results for the remainder of your retirement years.

Outlined profit plans defined

A pension is what monetary professionals name an outlined profit plan. As an alternative of getting an account which you can see rising, your employer guarantees you a particular month-to-month cost for the remainder of your life when you retire, based mostly on how lengthy you labored there and what you earned.

The method varies by employer. Some calculate advantages as a share of your common wage over your previous couple of years. Others would possibly common your whole profession or use your highest three consecutive years. Authorities pensions usually use totally different formulation than personal sector pensions.

What makes pensions notably invaluable and sophisticated is that they proceed paying till you die, and infrequently prolong to a surviving partner afterward. You’re not dividing a pot of cash – you’re dividing a stream of revenue that might final thirty or forty years into retirement.

The marital portion versus the separate portion

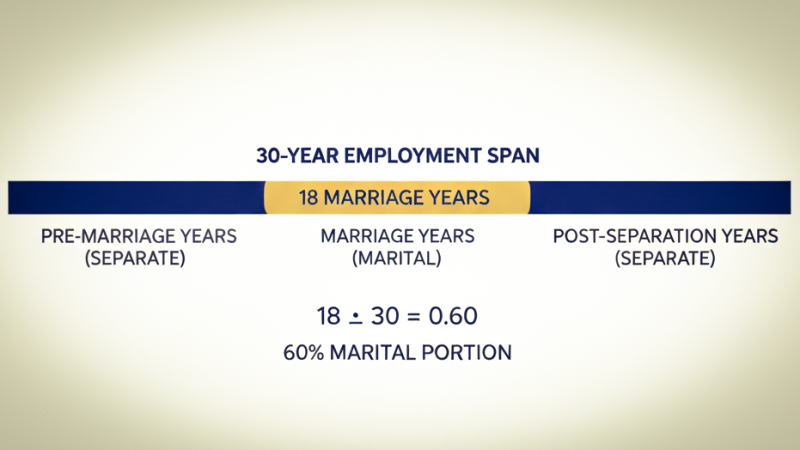

Simply because somebody has a pension doesn’t imply the complete profit will get divided. You’re solely dividing the portion earned throughout the marriage. Years labored earlier than marriage or after separation signify separate property.

That is the place the coverture method is available in. The method calculates the marital portion by dividing the years of service throughout the marriage by the full years of service at retirement.

In case your partner labored for a similar employer for thirty years complete and also you had been married for eighteen of these years, the marital portion is eighteen/30, or 60% of the pension advantages. That’s what will get divided between you. The opposite 40% stays with the worker partner.

If the divorce occurs earlier than retirement, you’re working with projections. You don’t know for certain what number of years they’ll finally work or what their remaining wage will probably be. That uncertainty is a part of what makes pension division so advanced.

Two approaches: rapid offset versus deferred distribution

When dividing a pension, you face a basic selection. You possibly can calculate the current worth of the marital portion and offset it with different belongings now – that’s rapid offset – or you may divide the precise pension funds once they begin sooner or later – that’s deferred distribution.

With rapid offset, you identify the marital portion’s worth in in the present day’s {dollars} and take different belongings equal to your share. Possibly you’ll get extra fairness in the home or a bigger share of funding accounts. You’re executed – you get your share now in belongings you management. The draw back is that current worth calculations require assumptions about life expectancy, rates of interest, and future funds that is perhaps unsuitable.

Deferred distribution means you’ll obtain a share of the pension funds once they begin. When your ex-spouse retires, you obtain your portion instantly from the pension administrator. You’re dividing the precise profit, not a projection. The draw back is you’re tied to their retirement timing and have to attend years for cash you would possibly want now.

We assist {couples} assume via which method is smart for his or her scenario. If the individual with the pension is near retirement, deferred distribution usually works higher. If retirement is twenty years away and also you want belongings now, a right away offset would possibly make sense – if we are able to agree on a good valuation.

Valuing a pension requires experience

When you could calculate what a pension is value in the present day, you’re getting into the sophisticated world of actuarial science. The current worth will depend on the month-to-month cost quantity, begin date, recipient’s anticipated lifespan, and the low cost fee.

We will estimate some components fairly – the pension method, projected funds, and life expectancy. However the low cost fee is contentious. The upper the speed, the decrease the current worth. Litigating {couples} rent competing actuaries who use totally different assumptions and arrive at valuations that differ by tons of of hundreds of {dollars}.

In mediation, we are able to agree on affordable assumptions or use federally printed low cost charges, fairly than combating over dueling consultants. My MBA in Finance allows me to elucidate these ideas clearly and assist you perceive how totally different assumptions influence valuation. We’re attempting to succeed in a good settlement based mostly on the very best accessible info, not win an argument about mathematical fashions.

Survivor advantages and cost-of-living changes

Many pensions provide survivor advantages – if the worker partner dies, the surviving partner continues receiving a portion of the pension. Your divorce settlement wants to handle whether or not the non-employee partner retains these survivor profit rights, or they’re usually misplaced.

Price-of-living changes matter enormously over time. A pension paying $3,000 month-to-month with a 2% annual COLA pays practically $5,500 month-to-month after thirty years. With out a COLA, that very same $3,000 has misplaced vital buying energy to inflation. Authorities pensions usually provide higher COLAs than private-sector pensions, which considerably impacts their long-term worth.

Early retirement and timing protections

What occurs if the worker partner desires to retire early with decreased advantages? Some home relations orders specify that the non-employee partner can begin receiving advantages when the worker partner first turns into eligible to retire, even when the worker partner doesn’t really retire then. This protects you from being held hostage to their retirement timing. These phrases are negotiable in mediation, and the framework you create will govern this asset for many years to come back.

Why mediation works higher for pension division

I’ve seen pension circumstances litigated the place every partner spent $20,000 or extra in authorized charges and professional witness prices – hiring dueling actuaries, combating over valuation methodologies, spending months in discovery, solely at hand the choice to somebody who doesn’t know their monetary life.

In mediation, we work collaboratively via these points. I leverage my MBA and specialised coaching from the Institute for Divorce Monetary Evaluation that can assist you perceive the numbers with out the expense of competing consultants. Should you want outdoors experience for a very advanced valuation, we are able to rent a single impartial professional that each of you should utilize, avoiding the battle of the consultants completely.

Most significantly, mediation allows inventive options that litigation can not accommodate. Maybe the partner with the pension may purchase out the opposite partner’s share by refinancing the home. You would possibly offset the pension in opposition to the 401(ok) or construction a cost plan tailor-made to your scenario.

Navigating advanced pension eventualities

Right here’s the place deep monetary experience turns into important. Authorities workers in California or New Jersey usually have CalPERS, CalSTRS, or state pension methods with particular division and survivor profit guidelines. Non-public-sector pensions would possibly embody early-retirement subsidies, which may have an effect on valuation. Some pensions permit lump-sum distributions, whereas others pay solely month-to-month advantages.

Suppose both partner has a number of pensions from totally different employers, or each a pension and a 401(ok), the complexity multiplies. How do you construction a division accounting for various profit sorts, tax therapies, and timelines? These aren’t easy arithmetic issues – they require monetary evaluation of your full image.

We will mannequin totally different eventualities: What if you happen to take out extra residence fairness and your partner retains a bigger share of the pension? How does that have an effect on your long-term monetary safety? What if there are vital age variations affecting life expectancy assumptions? These questions demand somebody who understands each the technicalities of pension valuation and methods to construction settlements that serve your long-term pursuits.

Energetic steerage via tough selections

We don’t anticipate you to grasp actuarial science or know the right reply to the rapid offset versus deferred distribution query. As an alternative, we actively information you thru every determination level based mostly in your age, monetary wants, different belongings, and tolerance for remaining related to your ex-spouse’s retirement selections.

What if the pension method contains uncommon components or there are beneficiary designation points? What if the worker partner is contemplating early retirement that might set off profit reductions? You’re not navigating these issues alone or hoping you didn’t overlook one thing vital.

Planning in your long-term safety

Dividing pensions isn’t nearly splitting what exists in the present day – it’s about guaranteeing you’re each positioned for monetary safety many years from now. What if the worker partner modifications careers and stops accruing pension advantages? What in the event that they get laid off earlier than retirement and the pension doesn’t absolutely vest? What if well being points power early retirement with decreased advantages?

We will’t predict each chance, however we are able to construct agreements that account for probably eventualities and offer you readability about what occurs if circumstances change. This future-focused method distinguishes mediation from litigation. In mediation, we are able to construct in provisions addressing what occurs as life unfolds, making a framework that gives safety and reduces future battle.

Don’t underestimate pension worth

The largest mistake I see with pensions is treating them as much less necessary than they really are. As a result of you may’t see a present account steadiness the way in which you may with a 401(ok), {couples} generally shortchange pension worth in negotiations, specializing in the home and funding accounts whereas treating the pension as an afterthought.

For somebody with twenty-five years at a job with an excellent pension, that pension is perhaps essentially the most invaluable asset within the marital property – value greater than the home, the 401(ok)s, and the whole lot else mixed. Giving up your share or accepting a lowball valuation can price you tons of of hundreds of {dollars} over the course of your retirement. Take the time to grasp what your partner’s pension is definitely value and make knowledgeable selections.

The selection that determines your retirement safety

Your method to dividing pensions will profoundly influence your monetary future. In litigation, you’re handing this vital determination to somebody who doesn’t know your scenario, hiring costly consultants to battle one another, and ending up with inflexible orders which may not serve both of you nicely.

In mediation, you keep management over these selections. You’re employed with somebody who has the monetary experience to information you thru the complexity, the negotiation abilities that can assist you attain honest agreements, and the dedication to making sure each spouses are positioned for long-term safety. You’re not combating over your pension – you’re working cooperatively to guard your retirement future.

The technical elements of pension division are genuinely advanced, however they’re manageable with correct steerage and a cooperative method. Your retirement safety deserves higher than courtroom battles and inflexible formulation utilized by individuals who don’t know your life. Select the trail that provides you management, flexibility, and confidence about your monetary future.