Marital Normal of Dwelling & Spousal Upkeep in Washington Defined

Right here’s a dialog I’ve nearly weekly in mediation. One partner says, “I can’t probably stay on lower than $8,000 a month—that’s what we spent throughout the marriage.” The opposite partner responds, “We had one family then, not two. The mathematics doesn’t work anymore.” Each are proper, each are annoyed, and we’re attempting to determine how the life-style you constructed collectively ought to affect the assist one partner pays the opposite after divorce.

What will get thought-about in Washington consists of “the usual of residing established throughout the marriage.” However this creates confusion as a result of it appears to vow the inconceivable: sustaining the identical way of life whereas supporting two separate households on primarily the identical earnings.

As a mediator with an MBA in Finance, I assist {couples} navigate this monetary problem by shifting previous emotional reactions and specializing in goal financial evaluation. The usual-of-living issue isn’t about guaranteeing nothing modifications—it’s about understanding what your way of life truly prices and utilizing that as a benchmark for honest upkeep negotiations.

What “Normal of Dwelling” Actually Means in Washington

When evaluating marital lifestyle in Washington, the main target is on the life-style you truly lived, not the life-style you may have or ought to have lived. For those who took costly holidays, belonged to a rustic membership, and dined out regularly, that’s your lifestyle, no matter whether or not you have been saving adequately for retirement.

This issues as a result of the evaluation appears to be like backward, not ahead. The query isn’t “what normal is cheap?” however “what normal did you determine?” This backward-looking method acknowledges that in lengthy marriages, each spouses usually construct their expectations round a particular way of life, and the lower-earning partner shouldn’t face a dramatic lower in lifestyle just because they lack impartial earnings.

However Washington additionally acknowledges that sustaining the identical normal post-divorce is usually financially inconceivable. One family turns into two, with duplicated housing prices, utilities, and most different bills. The emphasis is on contemplating the usual, not essentially sustaining it identically for each spouses.

This pressure between acknowledging marital way of life and accepting post-divorce realities is the place most upkeep negotiations both succeed or fail.

Documenting Normal of Dwelling Objectively

When {couples} insist they “want” a certain quantity to keep up their lifestyle, my first query is: what did that normal truly price throughout the marriage?

The one option to have productive conversations is to doc them objectively utilizing precise monetary information. We evaluation financial institution statements and bank card statements from the previous 12 months to know actual spending patterns.

We categorize bills into housing, transportation, meals, leisure, clothes, healthcare, insurance coverage, and discretionary spending. This train nearly at all times produces surprises. {Couples} who thought they wanted $10,000 a month uncover they really spent $7,500.

With my MBA in finance and almost 20 years of expertise analyzing {couples}’ monetary conditions, I can shortly determine spending patterns, distinguish between important and discretionary bills, and allow you to perceive what your way of life actually prices. This isn’t about judgment—it’s about attending to correct numbers so you possibly can negotiate from a basis of actuality moderately than assumptions or worry.

We’re conducting an expense evaluation that distinguishes between fastened prices and discretionary spending. Each are a part of your lifestyle, however they’ve completely different weights in upkeep negotiations.

The Math Drawback: When Two Can’t Dwell as Cheaply as One

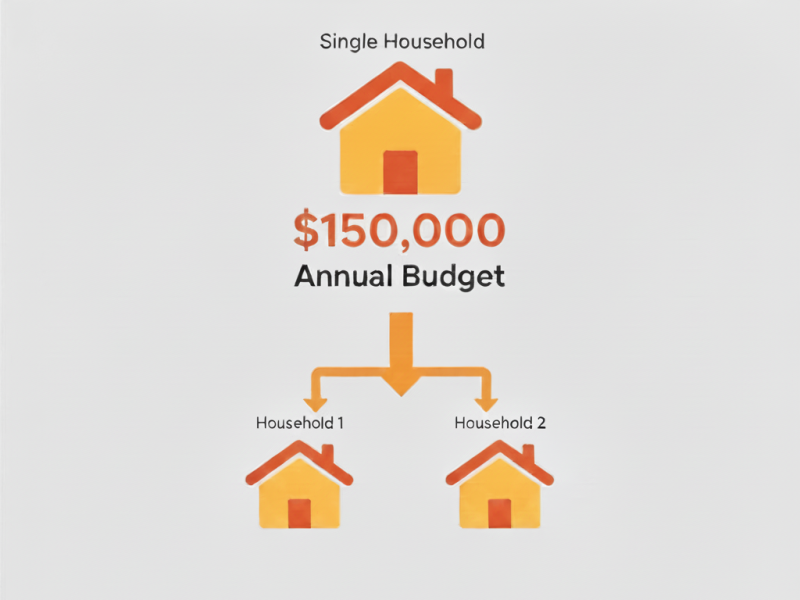

As soon as we perceive what your marital way of life prices, we face the basic math downside. Let’s say your family earnings was $180,000 yearly and also you spent $150,000 sustaining your way of life. Put up-divorce, that very same $180,000 now must assist two households.

Two separate households price extra. You may’t break up a mortgage fee and have two folks residing in equal housing—sure prices like housing, utilities, and primary family bills double or almost double.

Different prices don’t double or halve. For those who spent $1,200 month-to-month on groceries as a pair, every individual post-divorce may spend $700 moderately than $600, since you lose economies of scale.

I assist {couples} do practical modeling. If the higher-earning partner has $135,000 in post-divorce earnings and the lower-earning partner has $45,000, we mission the usual of residing every earnings truly helps. We run a number of eventualities with completely different upkeep quantities to see how every partner’s way of life would look beneath numerous preparations.

The mathematics often reveals that neither partner can keep the precise marital normal, and we’re negotiating the way to allocate restricted assets pretty inside these constraints. However we don’t simply deal with the instant problem of dividing assets. We allow you to anticipate how circumstances may change over time—what if the lower-earning partner’s earnings will increase, what if the upper earner faces job modifications, what if sudden bills come up. By planning for these potentialities now and constructing acceptable flexibility into your settlement, you possibly can transfer ahead confidently with out consistently wanting again.

Distinguishing Wants, Needs, and Marital Expectations

One in every of my roles is actively guiding you thru the method of distinguishing between wants, desires, and marital expectations. These overlap however aren’t equivalent, and we don’t depart you to determine this out by yourself.

Wants are bills required for protected, wholesome residing: ample housing, meals, transportation, and primary healthcare. Needs are discretionary bills like premium cable, health club memberships, and frequent eating out. Marital expectations are way of life patterns you established throughout marriage that fall between wants and needs.

The marital standard-of-living issue provides weight to these expectations. For those who belonged to a tennis membership all through your twenty-year marriage, that’s a part of your established normal. However marital expectations solely matter to the extent assets permit.

I assist {couples} create tiered price range eventualities that define minimal wants, average budgets with some marital expectations included, and budgets approximating the marital normal. Then we decide which state of affairs is achievable given the accessible earnings. This personalised method to budgeting—moderately than forcing you right into a one-size-fits-all template—helps you design upkeep preparations that really work for your loved ones’s particular circumstances.

The Strategic Method to Normal of Dwelling Discussions

When negotiating upkeep, I encourage {couples} to separate “what did we spend?” from “what can we afford now?”

Start by establishing the marital normal by a evaluation of monetary information. This creates a shared baseline that stops arguments about what your way of life “felt like” versus what it truly price.

Subsequent, mission practical post-divorce budgets for every partner that account for duplicative bills whereas sustaining cheap approximations of the marital normal the place doable.

Then, calculate the earnings accessible for upkeep after the higher-earning partner covers their cheap bills. If that accessible earnings absolutely helps the lower-earning partner at one thing near the marital normal, nice. If not, we’re negotiating the way to allocate restricted assets pretty.

I assist {couples} concentrate on the larger image, together with how property division impacts every partner’s capability to keep up their lifestyle. Generally, a bigger share of liquid belongings or the household house reduces the upkeep wanted to assist an affordable way of life. At different instances, a partner who takes on substantial debt wants decrease upkeep obligations to stay financially steady.

Managing Expectations About Life-style Modifications

One of the trustworthy truths I share is that divorce nearly at all times means way of life modifications. The assets that assist one family at a given normal hardly ever assist two households on the identical normal.

The first earner may want to simply accept that they will’t keep their entire marital way of life whereas offering substantial upkeep. The partner with a decrease earnings may want to simply accept that they gained’t be capable of keep the precise marital normal, even with cheap upkeep.

These changes don’t imply the standard-of-living issue is meaningless. It serves as a information and a purpose. The purpose is to supply upkeep that enables each spouses to stay as near the marital normal as assets allow.

In mediation, accepting this actuality is liberating. As soon as {couples} cease combating about sustaining an inconceivable normal and begin problem-solving round what’s truly achievable, productive negotiation turns into doable.

The Mediation Benefit: Management Over Your Monetary Future

In litigation, discussions of lifestyle change into weaponized. One lawyer presents inflated expense declarations to maximise upkeep claims—the opposite lawyer assaults each line merchandise, arguing that nothing was vital. A decide who doesn’t know the way you truly lived makes choices primarily based on competing expense declarations and no matter they determined within the final related case.

You lose management over the result, spend tens of hundreds in lawyer charges combating over way of life particulars, and find yourself with a upkeep quantity which will or might not replicate your precise circumstances.

In mediation, we take a very completely different method. We work by your precise monetary information collectively to create an trustworthy image of your way of life prices. We don’t require you to inflate or defend each expense—we’re patterns and realities. I actively information you thru creating practical post-divorce budgets that account for each spouses’ wants and the marital expectations you constructed collectively.

With my background in finance and intensive coaching from Harvard, MIT, and Northwestern, I carry analytical expertise that will help you perceive the true economics of sustaining completely different way of life ranges post-divorce. We are able to mannequin numerous upkeep eventualities and see exactly how every partner’s lifestyle would look beneath completely different preparations—not simply instantly after divorce, but additionally 5 years out and ten years out, accounting for modifications in incomes capability and life circumstances.

This type of complete, forward-thinking monetary evaluation helps you design upkeep preparations that protect significant relationships whereas offering each spouses with cheap monetary safety. You’re not combating over who “deserves” what way of life—you’re collaboratively fixing a monetary puzzle with somebody who has the experience to information you thru the complexity.

Shifting Ahead with Monetary Readability and Management

The marital lifestyle is an important consideration in Washington upkeep negotiations, nevertheless it’s one issue amongst many. The {couples} who attain the perfect agreements are those that perceive the precise price of their marital normal, settle for that post-divorce changes are inevitable, and concentrate on pretty allocating accessible assets moderately than combating over sustaining the inconceivable.

As your mediator, I can information you thru an goal evaluation of your marital way of life and allow you to develop practical post-divorce budgets that account for each spouses’ wants. I’m not an lawyer and may’t present authorized recommendation about what may occur in your particular case. However I may help you suppose by how the standard-of-living issue ought to affect your upkeep settlement, utilizing the identical rigorous monetary evaluation that might price tens of hundreds in litigation—however doing it cooperatively, effectively, and with way more flexibility to create options that really work.

Each couple’s scenario is exclusive, and that’s why we don’t consider in one-size-fits-all processes. We develop a personalised method to analyzing your lifestyle and designing upkeep buildings tailor-made to your particular wants and circumstances. This helps you defend what you’ve constructed, positions each of you properly on your respective futures, and permits you to finish your marriage with dignity moderately than by the adversarial, damaging litigation course of.

The purpose is reaching an settlement that acknowledges the life-style you constructed collectively whereas accepting the monetary realities of supporting two households—an settlement that each spouses really feel is honest and may stay with, permitting you to maneuver ahead with readability, cheap monetary safety, and hope for what comes subsequent.