Pure Diamond Costs – August 2025

August pricing displays stability in premium-grade diamonds, selective demand throughout mid-tier classes, and early indications of stability in lower-grade items. As lab-grown diamonds reshape the broader market, pure diamonds proceed to point out differentiated efficiency by readability and coloration tier.

Premium Grades

Prime-end stones remained steady. D/FL decreased barely from $12,840 to $12,698, whereas D/IF recorded a minor adjustment to $13,178, holding agency above $13,000. E/FL declined to $10,342, and E/IF eased to $9,132, each nonetheless inside anticipated margins. F/IF sustained its upward shift from July, closing at $11,232.

Demand on this class stays constant, pushed by rarity, investor confidence, and long-term worth retention.

Mid-Vary Grades

Motion throughout the mid-tier was combined. F/VVS1 elevated to $9,009, constructing on final month’s momentum. E/VVS2 rose to $8,175, whereas F/VS1 superior to $7,433. G/VS2 declined barely to $5,551, and H/VS2 was largely flat at $4,232.

This worth exercise displays cautious shopping for. Shoppers on this section proceed to judge price-to-appearance worth, typically cross-referencing towards premium lab-grown choices.

Decrease Grades

Some enchancment was famous in choose lower-grade pairings. I/SI1 elevated to $3,275, up from $3,221. Okay/SI2 ticked as much as $1,937, and J/SI1 rose to $2,558. H/SI1 and G/SI2 confirmed little motion.

Entry-level diamonds stay price-sensitive, however focused demand at particular readability/worth intersections is rising.

Market Implications

August tendencies reinforce a tiered market construction. Premium items stay steady and in demand. Mid-range stones proceed to commerce inside a tighter worth band, whereas decrease grades could also be approaching a ground. Continued segmentation can be crucial as pure diamonds navigate worth positioning in a lab-grown-influenced market.

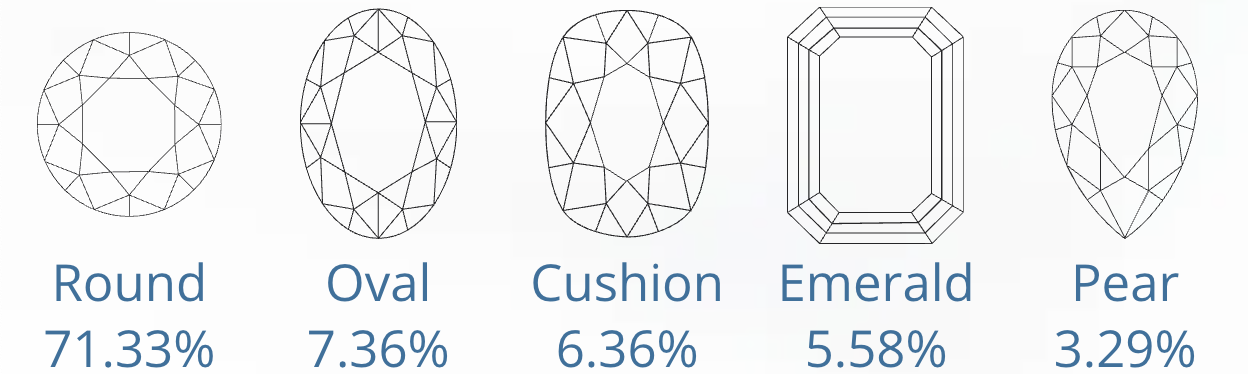

Common Diamond Shapes