Pure Diamond Costs – February 2025

In February 2025, the pure diamond marketplace for spherical diamonds within the 1.00–1.19 carat vary demonstrated intricate pricing changes throughout a number of readability and shade classes. These fluctuations, analyzed in our newest diamond pricing report, replicate nuanced shifts in supply-demand equilibrium, investor sentiment, and evolving client preferences, additional shaping the trajectory of the pure diamond market.

Premium Grades

The D shade, FL readability section skilled a slight improve, rising from $12,351 in January to $12,374 in February. Whereas this means continued demand for top-tier, flawless diamonds, the modest development suggests a stabilization following the early-year surge.

Equally, D/IF readability diamonds rose from $13,468 in January to $13,852 in February, reflecting regular curiosity in internally flawless diamonds inside this class.

Mid-Vary Grades

The mid-range classes exhibited combined worth actions. F shade, VVS2 readability diamonds declined from $7,517 in January to $7,445 in February, reflecting a slight dip in demand for high-clarity diamonds on this tier. Conversely, G/VVS2 readability diamonds noticed a modest improve from $6,053 in January to $6,118 in February, suggesting selective buying traits and strategic shopping for at this grade degree.

Decrease Grades

The SI readability section continued to expertise worth stress, notably within the decrease shade grades. J/SI1 diamonds declined from $2,641 in January to $2,357 in February, reflecting ongoing softness in demand for budget-conscious stones presumably because of shoppers making facet by facet comparisons with lab-grown diamonds. Ok/SI2 diamonds dropped additional to $1,827, emphasizing continued market recalibrations on the decrease finish.

Market Implications

The February 2025 traits reinforce a stabilization in premium diamonds, with D/IF and D/FL classes holding robust amid regular high-net-worth funding. The mid-range section stays fluid, with sure readability grades exhibiting resilience, whereas lower-tier diamonds proceed to say no, doubtless reflecting competitors from lab-grown options and a cautious post-holiday retail setting.

Because the pure diamond market navigates these traits, business stakeholders ought to monitor evolving demand patterns, notably in premium and mid-range classes, the place strategic shopping for continues to form worth actions.

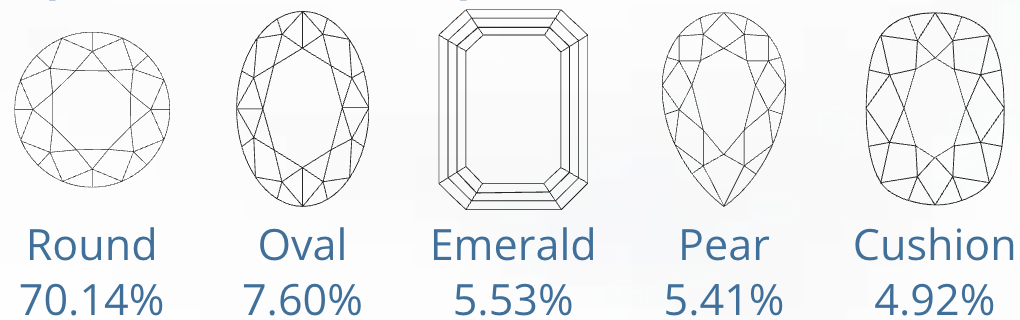

Standard Diamond Shapes

When searching for free diamonds, it’s vital to think about elements like reduce high quality and vendor providers, akin to improve choices and return insurance policies, which can considerably affect the worth. At PriceScope, we’ve been monitoring retail diamond costs since 2007, with over 1,200,000 diamonds at present in our database. Our Diamond Worth Chart web page, up to date month-to-month, presents complete worth insights for each spherical and fancy-shaped diamonds. Make sure you verify again for March 2025’s pure diamond worth updates.

Newest Publications on Diamond Costs February 2025:

Rapaport

IDEX

The Guardian