Pure Diamond Costs – July 2025

The pure diamond market in July 2025 revealed renewed power in premium-grade stones, continued volatility in mid-range choices, and lingering stress on lower-grade diamonds. As competitors from lab-grown diamonds intensifies, July’s information underscores a market in transition. Worth, rarity, and shifting client habits proceed to drive worth actions throughout classes.

Premium Grades

Premium diamonds demonstrated stronger efficiency in July. D/FL costs elevated modestly to $12,840 from $12,586, whereas D/IF held agency at $13,230, barely above June’s determine of $13,224. E/FL and E/IF additionally posted marginal will increase, suggesting regular demand for flawless and internally flawless stones. Notably, F/IF surged from $8,128 to $11,264, marking a big soar which will mirror both reclassification or an increase in demand for very high-clarity diamonds.

These actions point out a delicate resurgence in client and investor confidence on the higher finish of the market. Regardless of ongoing pressures in different segments, consumers proceed to favor premium high quality. This reaffirms the enduring worth proposition of pure diamonds on the highest readability ranges.

Mid-Vary Grades

Mid-range readability and shade combos introduced combined leads to July. F/VVS2 elevated sharply to $8,450 from $7,560, reflecting a stronger curiosity in diamonds that supply a steadiness of excessive readability and accessible pricing. In distinction, H/VS1 softened barely to $4,712 from $4,759, whereas E/VVS2 dipped to $7,960 from $8,053. G/VS1 and G/VS2 additionally skilled marginal changes, indicating fluctuating demand.

General, the mid-range section continues to draw regular curiosity. Patrons seem extra discerning, in search of optimum worth inside this high quality tier. These shifts mirror heightened worth sensitivity and better comparisons to lab-grown options that present comparable visible attraction at decrease prices.

Decrease Grades

Decrease-grade diamonds remained underneath stress in July, though just a few segments confirmed tentative indicators of stabilization. I/SI1 slipped to $3,221 from $3,349, and J/SI1 edged down barely to $2,537 from $2,550. Nevertheless, Ok/SI2 recorded a modest enhance, climbing from $1,834 to $1,849, suggesting early indicators of resilience on the entry-level.

Regardless of these slight actions, the broader pattern in lower-grade stones continues to level towards cautious client spending. Worth-conscious buyers more and more favour lab-grown choices that supply extra carat weight for much less funding.

Market Implications

The July traits mirror a market divided by readability and worth tier. Premium stones are regaining traction, supported by area of interest demand and the lasting status of high-quality pure diamonds. Mid-range diamonds are present process delicate realignment as shoppers consider worth extra carefully. Decrease-grade diamonds stay challenged, though some classes trace at restoration.

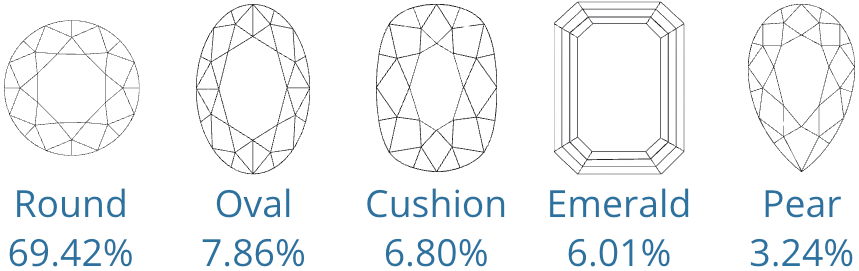

Well-liked Diamond Shapes