Pure Diamond Costs – March 2025

The pure diamond marketplace for spherical diamonds within the 1.00–1.19 carat vary in March 2025 revealed dynamic pricing developments throughout readability and coloration classes. These shifts, noticed in our newest diamond pricing report, make clear the enduring stability of market components, together with provide chain changes, evolving client habits, and aggressive pressures from the manufacturing of lab-grown diamonds.

Premium Grades

The upper-tier diamond classes demonstrated blended efficiency in March. D/FL readability diamonds noticed a slight decline, dropping from $12,374 in February to $12,092. This marginal dip suggests a softening demand for flawless diamonds, probably influenced by seasonal differences or cautious high-net-worth buying. Conversely, D/IF readability diamonds remained comparatively secure, transferring from $13,852 in February to $13,770 in March, reflecting sustained curiosity in internally flawless stones regardless of broader market changes.

Mid-Vary Grades

Standard amongst PriceScope members. The mid-range readability and coloration classes exhibited notable fluctuations. F/VVS1 readability diamonds rose barely from $8,495 in February to $8,507 in March, indicating regular demand for diamonds on this phase. Nevertheless, G/VVS2 readability diamonds skilled a extra vital improve, leaping from $6,118 in February to $6,187 in March. This upward development highlights selective shopping for patterns, with shoppers gravitating in the direction of value-focused premium choices inside the mid-range market.

In distinction, sure grades confronted downward strain. D/VVS1 diamonds dropped sharply from $10,517 in February to $8,382 in March, reflecting potential shifts in client preferences or stock changes by retailers. Equally, F/VVS2 diamonds declined barely from $7,445 to $7,393, suggesting a modest cooling in demand for this particular readability grade.

Decrease Grades

The lower-tier readability and coloration grades continued to face challenges, with some exceptions. J/SI1 diamonds noticed a marginal restoration, rising from $2,357 in February to $2,281 in March. This slight uptick might level to a stabilization in demand for budget-conscious stones, though the general class stays below strain. Alternatively, Ok/SI2 diamonds declined additional, dropping from $1,827 in February to $1,890 in March, emphasizing ongoing softness within the decrease finish of the market, seemingly exacerbated by the rising attraction of lab-grown diamonds.

Market Implications

The March 2025 developments reveal a nuanced image for the pure diamond market. Premium classes, whereas secure, present indicators of softening in sure high-clarity grades, suggesting a cautious method amongst high-end consumers. The mid-range phase continues to show resilience, with selective value will increase in key readability and coloration combos reflecting strategic buying. Nevertheless, the lower-tier classes stay below strain, pushed by competitors from lab-grown options and evolving client priorities.

Because the market adjusts to those dynamics, shoppers and stakeholders ought to concentrate on the evolving demand for mid-range and premium diamonds, the place strategic stock administration and aggressive pricing might help seize worth. Monitoring the impression of lab-grown diamonds on the decrease finish of the market may also be important as client preferences proceed to shift.

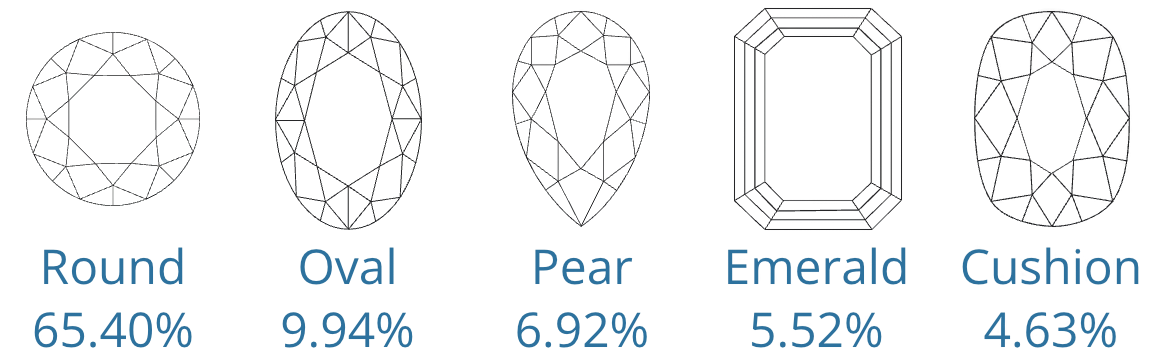

Standard Diamond Shapes

In our newest evaluation of the High 5 Standard Pure Diamond Shapes from February to March 2025, the pure diamond market revealed vital shifts in form preferences, reflecting evolving client habits.

Spherical diamonds, whereas nonetheless dominant, dropped from 70.14% in February to 65.40% in March (-4.74%). This decline suggests consumers are exploring various shapes however reinforces the Spherical reduce’s timeless attraction. Oval diamonds surged from 7.60% to 9.94% (+2.34%), solidifying their place as a contemporary favourite for these in search of elongated, elegant designs. Pear diamonds grew from 5.41% to six.92% (+1.51%), reflecting elevated curiosity of their distinctive teardrop silhouette and flexibility. Emerald cuts remained secure at 5.52%, showcasing their enduring attraction with clear traces and understated sophistication. Cushion cuts fell from 4.92% to 4.63% (-0.29%), persevering with their downward development as consumers favour extra structured shapes.

Newest Publications on Diamond Costs March 2025:

Rapaport