Spousal Upkeep in Washington: Brief vs. Lengthy Marriage Information

One of many first questions I hear from purchasers is: “Will I’ve to pay spousal upkeep?” The reply is determined by many components, and the size of marriage is likely one of the greatest. Understanding how Washington approaches upkeep briefly versus long-term marriages can assist you negotiate with readability quite than anxiousness.

Understanding Spousal Upkeep in Washington State

Washington makes use of the time period “spousal upkeep” quite than “alimony.” As a group property state, Washington usually divides marital property and earnings equally throughout divorce. However even after property division, one partner should still want monetary assist to keep up an inexpensive way of life or develop into self-sufficient.

Elements that come into play in Washington embrace every partner’s monetary assets after property division, the time wanted for schooling or coaching, the usual of dwelling throughout marriage, the period of the wedding, and every partner’s age and monetary obligations. This framework guides each decision-making and mediation discussions.

Two Phases of Spousal Upkeep: Understanding the Timeline

Spousal upkeep in Washington has two distinct phases. Understanding each is crucial for efficient negotiations.

Upkeep Pendente Lite: Help In the course of the Divorce Course of

Short-term upkeep, or “upkeep pendente lite,” offers monetary assist whereas your divorce is in course of. Divorce takes time, and payments don’t cease since you’ve separated. If one partner is the first breadwinner, short-term upkeep helps the opposite cowl primary dwelling bills throughout these months.

From a monetary planning perspective, this requires a transparent image of month-to-month money circulate. I work with purchasers to create detailed budgets that present precise transition bills—hire or mortgage, utilities, meals, transportation, insurance coverage, and child-related prices not lined by youngster assist. These are reasonable assessments of sustaining two households as a substitute of 1.

The strategic secret’s that short-term upkeep ends when your divorce is finalized. In mediation, {couples} can negotiate preparations that make sense for his or her scenario with out handing that call to a choose who doesn’t know them.

Put up-Decree Upkeep: Lengthy-Time period Monetary Help

Put up-decree upkeep begins after your divorce is last and might final months, years, or indefinitely. That is the place the size of marriage turns into essential. Length is taken into account one of the vital important components in figuring out whether or not upkeep ought to be awarded, for a way lengthy, and in what quantity. The longer you’re married, the extra your monetary lives intertwine, and the extra time the lower-earning partner may have to realize financial independence.

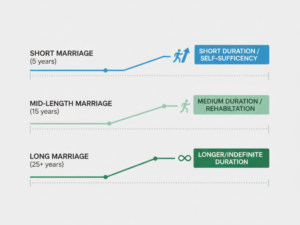

How Marriage Size Shapes Upkeep Expectations

Brief-Time period Marriages: Constructing Towards Independence

Marriages of lower than 5 years are typically thought-about short-term. The main target shifts from sustaining a marital way of life to serving to the lower-earning partner develop into self-sufficient.

Think about a three-year marriage through which one partner earns $90,000 whereas the opposite completes graduate college, incomes $30,000 part-time. Upkeep may bridge the hole whereas the lower-earning partner finishes their diploma and establishes their profession—maybe months or a few years, not a long time.

From a negotiation standpoint, discussions ought to deal with clear pathways to self-sufficiency. What schooling is required? How lengthy will it take? What’s the anticipated incomes potential? In mediation, {couples} with quick marriages typically construction inventive transitions—maybe reducing funds as earnings will increase, or a lump sum for a clear break and monetary certainty.

We don’t require you to determine these pathways by yourself. I actively information you thru the evaluation, bringing choices to the desk and serving to you discover what’s reasonable given your schooling, work historical past, and native job market. This sort of customized strategy—quite than forcing you into generic formulation—helps you design options tailor-made to your precise circumstances.

Lengthy-Time period Marriages: Recognizing Financial Partnership

Twenty-plus-year marriages symbolize a long time of financial partnership through which spouses made joint profession, instructional, and household selections. One partner could have sacrificed profession development to assist the opposite’s profession or elevate kids. These selections created the marital way of life that each spouses fairly anticipate to keep up after divorce.

Think about a thirty-year marriage: one partner earns $200,000 as a software program engineer whereas the opposite stayed house for fifteen years elevating kids, now incomes $40,000 part-time. The earnings disparity displays joint selections made throughout marriage, not poor planning.

Upkeep is perhaps indefinite—persevering with till the recipient remarries, both partner dies, or circumstances change considerably. The lower-earning partner could by no means obtain comparable incomes capability, and that’s a results of selections made inside the marital partnership.

Monetary evaluation right here turns into extra refined, together with retirement planning, Social Safety implications, healthcare prices, and long-term dwelling bills. With my MBA in finance and almost 20 years of expertise, I assist {couples} mission their monetary photos a long time into the long run. We mannequin completely different upkeep eventualities to see how every partner’s monetary safety seems to be in 5 years, 10 years, and in retirement. This complete evaluation helps you make knowledgeable selections quite than emotional ones pushed by worry or anger.

In mediation, discussions stability equity with actuality—the upper earner wants an inexpensive way of life and retirement financial savings, whereas the decrease earner wants monetary safety. However we don’t simply deal with the rapid challenges. We make it easier to anticipate how circumstances may change down the highway. What if the paying partner desires to retire early? What if the receiving partner’s well being adjustments? By planning for these prospects now and constructing acceptable flexibility into your settlement, you may transfer ahead confidently with out continuously wanting again.

Mid-Size Marriages: The Grey Space

Marriages of 5 to twenty years require probably the most cautious evaluation. A ten-year marriage through which each labored full-time differs vastly from one through which a partner stayed house with kids. Key components embrace how profession selections affected incomes capability, ages, reasonable incomes potential, and well being and employment stability.

Upkeep may final a particular period—maybe half the size of the wedding, or till a milestone like when the youngest youngster begins college. The aim is to supply assist whereas encouraging the lower-earning partner to extend self-sufficiency over time.

Monetary Issues Past Marriage Size

Whereas the size of marriage issues, refined negotiations think about different monetary components that considerably have an effect on the quantity and period of assist.

Neighborhood versus separate property is essential. Washington’s group property division occurs earlier than upkeep will get decided. If one partner receives substantial property—reminiscent of a worthwhile house or retirement accounts—these assets are factored into the analysis of wants. Somebody receiving $500,000 in property has completely different wants than somebody receiving $50,000, no matter similar incomes.

Tax implications modified after 2019. For divorces finalized after December 31, 2018, upkeep is not tax-deductible for the paying partner or taxable for the receiving partner. This considerably impacts calculations—the paying partner wants extra gross earnings to supply the identical web profit. Understanding this helps {couples} construction inventive options that maximize after-tax worth for each events. That is the place having a mediator with deep monetary experience makes an unlimited distinction in designing tax-efficient preparations.

The marital way of life additionally weighs closely. What will get thought-about in Washington consists of the life-style {couples} set up collectively. A pair dwelling modestly on a mixed earnings of $120,000 faces completely different calculations than one with a $400,000-per-year way of life. The longer the wedding, the extra this issue issues.

Strategic Approaches in Mediation

Profitable upkeep negotiations occur when {couples} strategy conversations in good religion and deal with the large image quite than combating over each greenback.

Begin with full monetary disclosure. Each spouses should share full data—earnings, property, money owed, bills, and future incomes potential. When individuals disguise property or underreport earnings, belief evaporates and negotiations fail. Open disclosure creates an surroundings the place honest options develop into potential.

Take into consideration upkeep as a part of your total monetary settlement, not in isolation. Generally paying extra in upkeep however receiving extra retirement property is sensible. Different occasions, shorter period with greater month-to-month quantities works higher. Have a look at your complete post-divorce monetary image and ask whether or not the settlement permits each of you to maneuver ahead with cheap monetary safety.

Creating monetary projections for various eventualities proves notably efficient. Examine $2,000 per 30 days for 5 years versus $1,500 per 30 days for seven years. What if funds lower over time as earnings will increase? Seeing numbers clearly helps {couples} discover frequent floor.

Think about the worth of certainty. Indefinite upkeep feels unsettling—payers surprise if it’s perpetually, recipients fear about termination. In mediation, you may set particular durations even in lengthy marriages, giving each events readability. You’re buying and selling some flexibility for peace of thoughts.

The Mediation Benefit Throughout All Marriage Lengths

Whether or not your marriage was quick or lengthy, mediation provides distinct benefits over litigation for upkeep negotiations. In courtroom, you’re caught with inflexible classes and judicial tips. Your three-year marriage will get handled identical to each different three-year marriage, no matter your distinctive circumstances. Your twenty-five-year marriage will get processed via the identical template because the final one the choose dealt with.

In mediation, we develop customized options that replicate your precise scenario. Brief marriage the place one partner supported the opposite via medical college? We will construction upkeep that acknowledges that funding. Lengthy marriage with advanced property and retirement concerns? We will combine property division with upkeep to create a complete monetary plan that protects what you’ve constructed.

Each couple’s scenario is exclusive, and that’s why we don’t consider in one-size-fits-all processes. As an alternative, we develop a personalised mediation plan to deal with your particular wants and circumstances. With my coaching from Harvard, MIT, and Northwestern, mixed with my MBA in finance, I carry each the negotiation abilities and monetary experience that can assist you navigate even probably the most advanced upkeep discussions—whether or not you’re coping with enterprise earnings, inventory compensation, or refined retirement planning.

In litigation, these negotiations develop into adversarial battles through which attorneys argue for probably the most excessive positions, and judges cut up the distinction. You spend tens of hundreds in authorized charges, lose management over the end result, and sometimes find yourself with upkeep preparations that don’t replicate the financial actuality of your scenario.

In mediation, we work via the evaluation collaboratively. I actively information you thru the mandatory concerns—you don’t want to come back in with all of the solutions or struggle for each place. We discover inventive buildings reminiscent of step-down upkeep, milestone-based preparations, or lump-sum buyouts that might be almost unimaginable to realize via the inflexible litigation course of.

Shifting Ahead with Readability and Management

Whether or not your marriage lasted three years or thirty, understanding how Washington approaches spousal upkeep offers a basis for productive conversations about your monetary future. Marriage size issues, however it’s only one think about a fancy equation that features your distinctive circumstances, assets, and priorities.

The {couples} who attain the perfect upkeep agreements are those that strategy these conversations with honesty, a willingness to discover honest options, and the steering of an skilled mediator who understands each the monetary complexities and the negotiation methods that result in sustainable agreements.

I’m not an lawyer and might’t present authorized recommendation about what may occur in your particular case. However I can supply complete monetary evaluation of various upkeep choices, steering on productive conversations that transfer previous emotional reactions, and facilitation of negotiations that result in workable agreements each spouses can stay with.

In mediation, you may create agreements that work in your particular scenario quite than accepting inflexible courtroom formulation. You keep management over selections about your monetary future, you design options that replicate your precise incomes potential and bills, and also you protect significant relationships—notably essential when you’re co-parenting.

Your divorce is a transition, not simply an ending. Upkeep selections have an effect on your monetary safety for years to come back. Selecting mediation with the best experience—somebody who can deal with refined monetary evaluation, information you thru advanced negotiations, and make it easier to design options that account for future adjustments—is an funding in your future that pays dividends lengthy after your divorce is last.