Understanding Spousal Upkeep Quantities in Washington: A Full Monetary Information

In the event you’re going through divorce in Washington, determining spousal upkeep can really feel overwhelming. Not like baby assist, which has easy pointers, upkeep has no method. How Washington approaches spousal upkeep offers {couples} important flexibility, which may really feel frustratingly imprecise if you’re making an attempt to plan your monetary future.

The excellent news? In mediation, you may conduct an intensive monetary evaluation that goes far past surface-level numbers. As a mediator with an MBA in Finance, I information {couples} by way of a complete assessment to assist them attain upkeep agreements grounded in actual information fairly than concern or emotion.

Past Floor-Stage Numbers: The Actual Monetary Evaluation

When {couples} come to me for mediation, they usually arrive with fundamental numbers. “I make $150,000, and my finances is $6,000 month-to-month.” “I solely make $75,000 and want $6,500 to reside on.”

These are beginning factors, however nowhere close to adequate. My job is to information you thru a deeper evaluation that examines not simply your present earnings and spending, but in addition your monetary panorama post-divorce. We’re primarily constructing monetary projections for 2 separate households.

This begins with complete documentation. You’ll want latest pay stubs, at the least two years of tax returns, revenue and loss statements if self-employed, financial institution and bank card statements, retirement account statements, and detailed expense information. Incomplete data results in incomplete agreements that always disintegrate later.

Earnings Evaluation: Extra Advanced Than You Suppose

Earnings appears easy till you dig into it. Even W-2 staff want to think about components past their base wage. Do you obtain bonuses or commissions? How constant are they? Inventory choices vesting? Time beyond regulation pay?

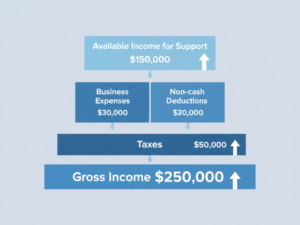

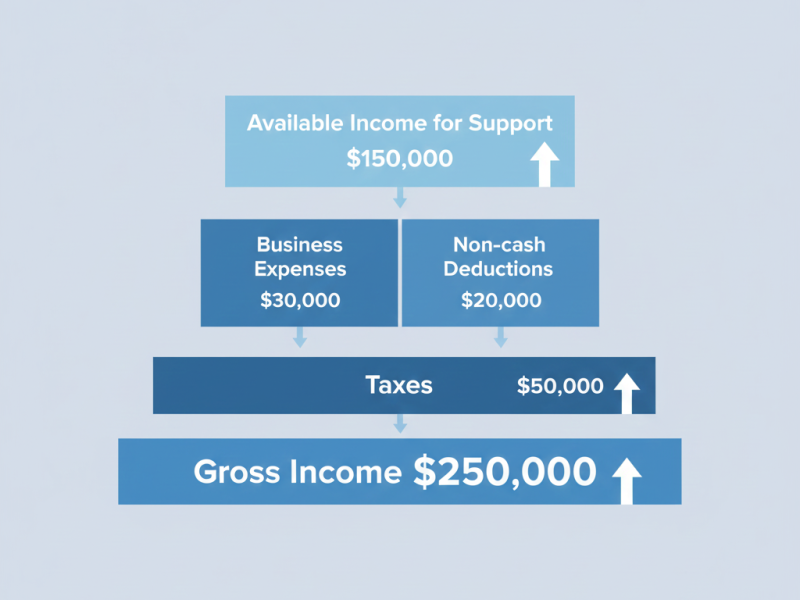

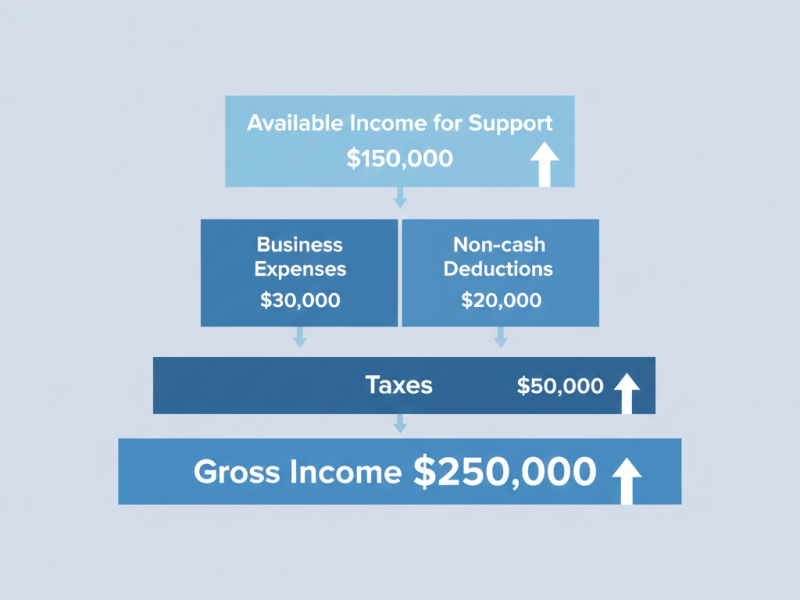

For self-employed people, evaluation turns into considerably extra complicated. Your tax return exhibits one quantity, however is that your precise out there earnings? Self-employed people usually have professional enterprise bills that cut back taxable earnings however don’t essentially cut back money circulation. We could have to reinstate depreciation or sure bills to find out the precise financial earnings out there for assist precisely.

I’ve labored with enterprise house owners who declare they “solely make $50,000 a yr” per their tax return. Nonetheless, they’re driving an organization automobile, the enterprise pays their cellular phone and medical insurance, and so they have important discretionary spending working by way of the enterprise. This isn’t about hiding earnings—it’s about understanding the whole financial image.

We additionally take into account earnings traits. Is your earnings prone to improve, lower, or stay secure? In the event you’re in commission-based gross sales and the previous two years had been unusually excessive, is that sustainable? In the event you’ve been out of the workforce however have skilled credentials, we have to assess your incomes capability—not simply your present earnings—in a practical approach.

This sort of refined earnings evaluation is crucial if you’re coping with complicated compensation constructions. In case your earnings contain bonuses, inventory choices, RSUs, or fairness shares, it may be onerous to see a transparent approach ahead. With my MBA in finance and practically 20 years of expertise analyzing these conditions, I can assist you chop by way of the monetary complexity to grasp what earnings is definitely out there for assist and what every partner really wants.

Submit-Divorce Price range Actuality: When One Family Turns into Two

As soon as we perceive earnings, we flip to bills. That is the place {couples} wrestle as a result of they’re projecting bills for a life they’re not but dwelling. Throughout your marriage, you shared one family and its on a regular basis bills. Submit-divorce, you’ll have two households with duplicated bills.

We categorize bills into fastened prices—similar to housing, insurance coverage, and automobile funds—and variable prices—similar to groceries, utilities, and leisure. However extra importantly, we talk about how these change after divorce. What is going to your new housing price? Are you able to afford to keep up the household house by yourself? What about medical insurance if you happen to’ve been coated below your partner’s plan?

One space that constantly surprises individuals is the precise price of sustaining their way of life. Throughout marriage, you could have spent round $1,200 month-to-month on groceries and eating. Submit-divorce, every family may pay $800 month-to-month as a result of there’s much less effectivity.

I information purchasers by way of creating two detailed post-divorce budgets accounting for all these adjustments. We’re not simply mandatory bills, but in addition prices reflecting the marital lifestyle—fitness center memberships, youngsters’ actions, journey. What will get thought of in Washington consists of the usual of dwelling established throughout marriage, so understanding what that truly prices is essential.

Tax Implications within the Submit-2019 Panorama

Right here’s the place my finance background turns into significantly invaluable. Earlier than 2019, upkeep was tax-deductible for the payor and taxable to the recipient. The Tax Cuts and Jobs Act modified all the things. Upkeep paid below divorce agreements executed after December 31, 2018, is not deductible or taxable.

This essentially altered upkeep economics. In the event you’re the higher-earning partner within the 32% federal tax bracket, each upkeep greenback you pay prices a complete greenback of after-tax earnings. Beforehand, it will have price about 68 cents. For the recipient partner within the 12% bracket, you’re receiving that greenback tax-free as a substitute of netting 88 cents after taxes.

I assist {couples} perceive these implications when structuring agreements. Generally we modify the upkeep quantity based mostly on the tax therapy. Different occasions, we discover various constructions, similar to a bigger property division instead of ongoing upkeep, particularly if the payor has substantial property and each events want a clear break.

We additionally take into account how upkeep impacts different tax points. How will submitting standing change? What about dependency exemptions? Will receiving upkeep have an effect on eligibility for sure credit? These nuances matter when projecting your post-divorce monetary image.

Washington’s Group Property Issue

Washington’s neighborhood property system provides one other layer. How upkeep will get decided occurs after contemplating property division, not earlier than. We have to perceive not solely earnings and bills, but in addition the property every partner will obtain.

Suppose the lower-earning partner receives substantial liquid property or income-producing property, which impacts their upkeep wants if the higher-earning partner takes on important neighborhood debt, which in flip impacts their capacity to pay. I information {couples} by way of a holistic evaluation that considers property settlement and upkeep collectively.

Generally {couples} uncover they’d want to construction their settlement in a different way. Maybe one partner would really like a bigger property settlement with lowered upkeep. Maybe the opposite occasion would recognize ongoing assist alongside a smaller, rapid property division. These conversations solely occur when you will have full monetary readability.

Modeling Completely different Eventualities in Mediation

As soon as we’ve gathered and analyzed monetary data, we are able to have significant conversations grounded in actuality. You’ll perceive not simply what “feels truthful,” however what’s truly supportable given out there sources.

I usually create spreadsheets modeling completely different eventualities. What if upkeep is $2,000 per 30 days for 5 years? What does every partner’s finances appear to be? What if it’s $3,000 per 30 days for 3 years? How do these constructions have an effect on every individual’s monetary stability? Can the paying partner truly afford the proposed quantity whereas assembly their very own affordable wants? Will the receiving partner have adequate sources to transition to self-sufficiency?

This degree of research takes effort and time, nevertheless it’s value it. I’ve seen {couples} attain agreements they each be ok with as a result of they perceive the numbers behind the choice. They’re agreeing as a result of they’ve executed the mathematics, and the deal is smart for his or her scenario.

However we don’t simply sort out the rapid challenges of figuring out upkeep. We enable you to anticipate how issues may change down the highway. What if the paying partner loses their job or will get a major promotion? What if the receiving partner remarries or begins incomes extra? By planning for these potential adjustments now, we enable you to construct flexibility into your settlement so you may transfer ahead confidently, with out continuously wanting again or worrying about future disputes.

Important Documentation to Collect

To conduct complete monetary evaluation, collect at the least two years of tax returns with all schedules, six months of pay stubs for each spouses, six months of financial institution and bank card statements, documentation of all money owed, retirement and funding account statements, property value determinations or assessments, enterprise valuations if relevant, detailed month-to-month expense documentation, and details about employer advantages together with medical insurance prices and retirement contributions.

Sure, it’s in depth. However in litigation, you’d present all this anyway by way of formal discovery. In mediation, you share data voluntarily and collaboratively, which is quicker, cheaper, and fewer adversarial.

Shifting Ahead with Readability and Management

Having a mediator who can information you thru rigorous monetary evaluation transforms the negotiation course of. As a substitute of taking positions based mostly on concern or combating over what may occur in courtroom, you’re making selections based mostly on actual information about earnings, bills, property, and tax implications.

In litigation, you’d be caught with no matter quantity a decide decides based mostly on restricted testimony and inflexible pointers. You’d don’t have any management over artistic options or future planning. In mediation, you design a upkeep construction that truly is smart for your loved ones’s particular circumstances.

As your mediator, I can not present authorized recommendation about what may occur in your particular case. However I can assist you perceive your full monetary image and information you thru creating an settlement that works for each spouses, given your circumstances. With practically 20 years of expertise and specialised coaching from Harvard, MIT, and Northwestern, I carry the monetary experience and negotiation expertise that assist {couples} navigate even probably the most complicated upkeep conditions.

The aim is reaching a upkeep settlement that permits each of you to keep up an affordable lifestyle, accounts for post-divorce monetary realities, protects what you’ve constructed, and provides each events confidence that the deal is truthful and sustainable. That type of settlement is just potential if you’ve executed the onerous work of gathering data, analyzing the numbers actually, and selecting mediation over the uncertainty of litigation.